At the halfway point of his administration, Virginia Gov. Glenn Youngkin unveiled a budget proposal that calls for significant income tax cuts, increases in state sales and use tax — and a push to get rid of the car tax, which the Republican called “the single most hated tax” in Virginia.

“The car tax belongs in the trash can and not in your mailbox,” he said.

Speaking to the state’s joint money committees Wednesday morning, Youngkin reiterated his familiar themes that Virginia must take action to reverse ongoing population losses to other states and reduce residents’ tax burdens.

“Across the country today, there are winning states and there are losing states,” he said. “Virginia must compete even harder.”

But the governor’s speech took a less political tone than earlier addresses to the state’s legislative budget architects, offering fewer criticisms of prior administrations and acknowledging that Virginia government remains divided after Democrats narrowly won control of both chambers of the legislature this November. That outcome dampened Youngkin’s prospects for a presidential run and will force him to work across the aisle to achieve his key priorities.

Because Virginia operates on a two-year budget that is amended annually, the “Unleashing Opportunity” budget presented by Youngkin Wednesday represents the governor’s first crack at crafting a state spending plan from whole cloth. The last two-year budget, which was passed in 2022, was based on a plan from outgoing Democratic Gov. Ralph Northam.

With power divided between Democrats and Republicans in Richmond and historic state surpluses fueled by pandemic-era relief spending, the past few years have seen unusual levels of contention over the state budget. Amendments to the spending plan, ordinarily passed at the time the General Assembly adjourns in late February or early March, took until September this year to come to fruition as the parties bickered.

“I would ask us to deliver a budget on time when you adjourn sine die in March,” Youngkin told the money committees on Wednesday, referring to the final adjournment of the legislative session. “Virginians deserve it, and I know we can do it.”

This year, lawmakers will have less money at their disposal, with pandemic-era infusions of cash at an end and state economic officials projecting a mild recession beginning in the last quarter of fiscal year 2024.

The “overwhelming consensus” of state leaders, said Youngkin, was that in developing the budget, “we should build in caution.”

Democrats have already signaled concerns with the governor’s spending plan — and some surprise.

“I heard the governor say this was halftime. And he came back out as a Democrat, a lot of tax increases,” wisecracked incoming House Speaker Don Scott, D-Portsmouth, in an exchange with Virginia Secretary of Finance Stephen Cummings.

Senate Democrats on Wednesday afternoon issued a statement calling the governor’s budget “absolutely disgraceful” and “a slap in the face of our most vulnerable individuals.”

“We are smart enough and bold enough to know that his speech was the highlight reel and that he omitted the dirty details of his plan,” the caucus wrote. “Governor Youngkin believes that ensuring more tax cuts for wealthier individuals is most beneficial for low income individuals in our commonwealth.”

The proposal put forward by the governor Wednesday marks only the beginning of the state’s budget season. When the General Assembly convenes Jan. 10, both chambers will have a chance to modify Youngkin’s budget, removing parts they don’t like and accepting or strengthening those they do. The House and Senate will then need to reconcile their two versions of the plan — a process that historically has occurred behind closed doors through the legislature’s opaque conference committee system — and send it to the governor for his review.

“While we appreciate Governor Youngkin for sharing his budgetary vision today, it is imperative that we have a thorough examination of his proposal,” said Del. Luke Torian, D-Prince William, the incoming chair of the House Appropriations Committee. “This is the starting point to construct a budget that not only reflects our dedication, but also secures prosperity and fairness for every resident in the commonwealth.”

Here’s some of what Youngkin is proposing at the starting line.

Tax reforms

Youngkin has heavily emphasized tax reduction over the course of his administration, and the issue is the centerpiece of his budget proposal. Reducing the cost of living for Virginians, he argued Wednesday, requires reducing tax burdens and modernizing the state’s sales tax code.

He is calling for a 12% cut in income taxes across the board that would see the tax rate drop from 2% to 1.75% for the lowest bracket and from 5.75% to 5.1% for the highest.

“This cut reduces the personal income tax burden on Virginians by $1.1 billion in fiscal year 2025 and $2.3 billion in fiscal year 2026 and is a major, major step towards competing,” Youngkin said. “The data is clear: Since 2021, 26 states have cut individual income tax rates.”

To partly offset that loss in state revenues, the governor is proposing to increase the state’s sales and use tax from 4.3% to 5.2%, as well as expand the base of goods and services that tax applies to.

“Virginia taxes a narrow set of goods while our peer states tax a broader set of goods and services,” said Youngkin. To remedy that, he is asking the state to close what he called the “Big Tech tax loophole” on digital goods such as software packages, digital downloads, streaming services and more, “on which today, Virginia collects nothing.”

Democrats have already pushed back against the tax changes. In a statement, Scott said Virginia “must champion policies that address the pressing issues faced by our citizens – not those that would be detrimental to the financial well-being of low-income and middle class households, exacerbating economic disparities. By lowering taxes for the wealthiest Virginians and raising local and state sales tax, the burden is shifted onto those least able to afford it.”

Asked about those concerns, Youngkin said he was “very cognizant” of them, “and that’s why we included an increase in the earned income tax credit, so that in fact there would be support for Virginians who are on the lower-income scale.”

Under the governor’s plan, lower-income residents would be able to claim an enhanced earned income tax credit equal to 25% of the federal credit, rather than the existing 20% credit.

“We can reduce the tax burden and include a very important tax reform, which is shifting the burden of personal income taxes onto a sales tax system that is truly outdated and archaic,” he said.

Car tax

While not included in his budget plan, the governor urged lawmakers to work to permanently eliminate the car tax local governments are currently allowed to levy and instead have localities rely on further increases in sales tax.

“Everywhere I go, I consistently hear, ‘Please help us get rid of the car tax,’” he told reporters. “We need to work together to get rid of this.”

Outgoing Sen. John Edwards, D-Roanoke, noted the commonwealth spends almost $1 billion annually to reduce the car tax in localities and asked whether getting rid of the tax would require a constitutional amendment.

“The [Virginia] Constitution gives the car tax to the localities,” he said. “So how’s [he] going to do that, to abolish the car tax?”

Cummings said eliminating the tax would require a complex process and “a lot of changes and legislation.”

After his presentation, Youngkin told reporters, “I believe we would not eliminate the state subsidy of $950 million a year, that we can work in collaboration with local governments to settle on an increase in local and state sales and use taxes.”

Continued increases in education spending

Over the next biennium, Youngkin is proposing an additional $764 million for Virginia’s K-12 schools, including $160 million for re-benchmarking — the process of updating the amounts the state provides in direct aid to schools — $122 million to cover another 2% raise for teachers in fiscal year 2026 and $53 million for a 1% bonus in fiscal year 2025.

Youngkin also proposed investing $61 million to expand the hiring of reading specialists, $40 million to support students seeking industry-recognized credentials through “Diploma Plus” grants and $40 million to develop a new state assessment system.

More behavioral health investments

Youngkin is proposing $316 million in the budget for his “Right Help, Right Now” plan to further expand access to behavioral and mental health services across the commonwealth. This includes over $150 million to add additional developmental disability waivers, which fund services for people with long-term care needs. The governor’s plan aims to provide waivers to the 3,400 Virginians currently on the “priority one” waitlist — consisting of those individuals who urgently need the services and support offered by the waiver in a year or less.

“This is going to be a big initiative, but with the providers out there seeing this money is there, I think we can generate the kind of infrastructure we need to help address this important area,” said Virginia Department of Planning and Budget Director Michael Maul.

Over $35 million will go toward funding additional crisis services, like Virginia’s 988 suicide and crisis system and crisis stabilization units, to minimize response services that rely on emergency rooms and hospitals.

An additional $58 million is being invested in behavioral health loan repayment, more clinical training sites and residency slots and salary increases for state hospital clinicians. A new JLARC report this month found Virginia’s nine psychiatric hospitals are increasingly short on both beds and staff, which poses risks for both patients and personnel.

When it comes to hiring, “we are competing with McDonalds and Starbucks,” Maul said, “and it’s hard sometimes to get the people we need.”

Medicaid spending

The budget includes $714 million to fund the cost of Medicaid while adjusting for inflation.

Maul said this biennial budget includes significantly more money than the previous two-year spending plan because the state’s Health Care Fund, which is sourced from tobacco taxes, has less money to cover Medicaid costs than it did in prior years.

During COVID, Maul said Medicaid enrollees “weren’t going to their doctors or getting their checkups,” so Virginia spent less to pay for providers than what was initially budgeted. Now, he said, the state is expecting a significant rise in utilization.

“We’re not expecting very big amounts to go into the Health Care Fund, and tobacco tax revenues are going down,” Maul said. “We believe we’re going to need over $250 million a year to help offset the fact that those funds will not be available to help with Medicaid.”

Child care

The Building Blocks for Virginia Families initiative, announced by Youngkin earlier this month, would put $437 million toward child care and early childhood education programs in an effort to keep child care accessible to families struggling to shoulder its high costs.

Wednesday’s proposal is $10 million less than the governor previously outlined but would put $412 million toward the state child care subsidy program and $25 million to help with startup costs for providers in areas that lack child care services.

“We were using a big chunk of one-time funding, of public funding, to help subsidize the cost for child care,” said Maul. “That’s one of our biggest economic development issues, because if workers can’t find child care, they can’t get to work.”

A state report by the Joint Legislative Audit and Review Commission recently found that child care is unaffordable for the vast majority of Virginians.

“The whole goal is to make sure that anybody in the program today and those who would likely be in the program can continue to do so in the next biennium,” said Maul.

No new increases for Metro

Despite Metro’s threats of potential service cuts and fare increases in response to a $750 million shortfall, the governor’s budget includes no additional funding for the bus and rail operator above the state’s normal allocation.

Youngkin said before any funding is appropriated, a plan must be created to address the change in ridership and demand for services.

A view of the Tysons Corner Metrorail Station in Fairfax County. (Nathaniel Cline/Virginia Mercury)

“I am a huge supporter of Metro,” Youngkin said after his presentation. “It is critically important to Virginia and the entire DMV. But we need to face reality here and develop a business plan that works for Virginia, for the District and for Maryland, and then we will talk about what we will do in order to support it.”

Metro said Virginia’s proposed contribution for fiscal year 2025 is $347.9 million.

Metro said it needs notification of what the neighboring jurisdictions will provide by mid-March to make any budget adjustments.

Photo via Virginia House of Delegates/Flickr. This article was reported and written by Sarah Vogelsong, Nathaniel Cline, Charlie Paullin and Meghan McIntyre for the Virginia Mercury, and has been reprinted under a Creative Commons license, with some edits for length.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

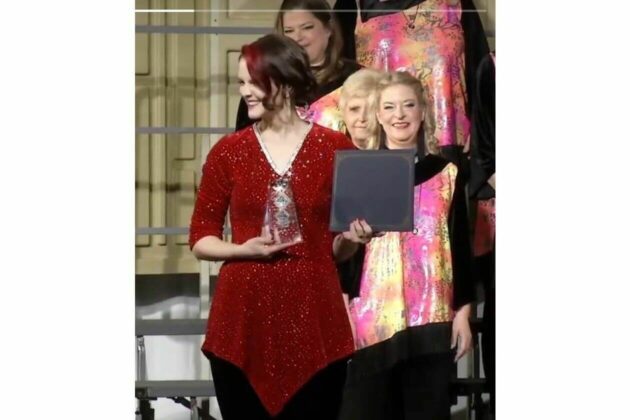

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Pedal with Petals Family Bike Ride

Join us on Saturday, May 11th and ride into spring during our Pedal with Petals Family Bike Ride. Back for its second year, Pedal with Petals is going to be bigger than ever. This year’s event will include both an

Encore Creativity for Older Adults at Capital One Hall

Encore Creativity for Older Adults is pleased to raise the curtain and welcome community members to its spring concert at Capital One Hall in Tysons, VA on May 4, 2024. The concert, which starts at 3 PM, will bring hundreds