At the halfway point of his administration, Virginia Gov. Glenn Youngkin unveiled a budget proposal that calls for significant income tax cuts, increases in state sales and use tax — and a push to get rid of the car tax, which the Republican called “the single most hated tax” in Virginia.

“The car tax belongs in the trash can and not in your mailbox,” he said.

Speaking to the state’s joint money committees Wednesday morning, Youngkin reiterated his familiar themes that Virginia must take action to reverse ongoing population losses to other states and reduce residents’ tax burdens.

“Across the country today, there are winning states and there are losing states,” he said. “Virginia must compete even harder.”

But the governor’s speech took a less political tone than earlier addresses to the state’s legislative budget architects, offering fewer criticisms of prior administrations and acknowledging that Virginia government remains divided after Democrats narrowly won control of both chambers of the legislature this November. That outcome dampened Youngkin’s prospects for a presidential run and will force him to work across the aisle to achieve his key priorities.

Because Virginia operates on a two-year budget that is amended annually, the “Unleashing Opportunity” budget presented by Youngkin Wednesday represents the governor’s first crack at crafting a state spending plan from whole cloth. The last two-year budget, which was passed in 2022, was based on a plan from outgoing Democratic Gov. Ralph Northam.

With power divided between Democrats and Republicans in Richmond and historic state surpluses fueled by pandemic-era relief spending, the past few years have seen unusual levels of contention over the state budget. Amendments to the spending plan, ordinarily passed at the time the General Assembly adjourns in late February or early March, took until September this year to come to fruition as the parties bickered.

“I would ask us to deliver a budget on time when you adjourn sine die in March,” Youngkin told the money committees on Wednesday, referring to the final adjournment of the legislative session. “Virginians deserve it, and I know we can do it.”

This year, lawmakers will have less money at their disposal, with pandemic-era infusions of cash at an end and state economic officials projecting a mild recession beginning in the last quarter of fiscal year 2024.

The “overwhelming consensus” of state leaders, said Youngkin, was that in developing the budget, “we should build in caution.”

Democrats have already signaled concerns with the governor’s spending plan — and some surprise.

“I heard the governor say this was halftime. And he came back out as a Democrat, a lot of tax increases,” wisecracked incoming House Speaker Don Scott, D-Portsmouth, in an exchange with Virginia Secretary of Finance Stephen Cummings.

Senate Democrats on Wednesday afternoon issued a statement calling the governor’s budget “absolutely disgraceful” and “a slap in the face of our most vulnerable individuals.”

“We are smart enough and bold enough to know that his speech was the highlight reel and that he omitted the dirty details of his plan,” the caucus wrote. “Governor Youngkin believes that ensuring more tax cuts for wealthier individuals is most beneficial for low income individuals in our commonwealth.”

The proposal put forward by the governor Wednesday marks only the beginning of the state’s budget season. When the General Assembly convenes Jan. 10, both chambers will have a chance to modify Youngkin’s budget, removing parts they don’t like and accepting or strengthening those they do. The House and Senate will then need to reconcile their two versions of the plan — a process that historically has occurred behind closed doors through the legislature’s opaque conference committee system — and send it to the governor for his review.

“While we appreciate Governor Youngkin for sharing his budgetary vision today, it is imperative that we have a thorough examination of his proposal,” said Del. Luke Torian, D-Prince William, the incoming chair of the House Appropriations Committee. “This is the starting point to construct a budget that not only reflects our dedication, but also secures prosperity and fairness for every resident in the commonwealth.”

Here’s some of what Youngkin is proposing at the starting line. Read More

The Virginia Board of Education is asking the General Assembly to develop a plan for changing the state’s existing school funding formula to help divisions strapped for money but isn’t backing a proposal to remove a cap that limits the number of support positions the state will fund.

According to an earlier report by the Joint Legislative Audit and Review Commission, which conducts analysis and provides oversight of state agencies on behalf of the General Assembly, changing the formula could help address the underfunding of schools.

“We don’t have a good school financing system in Virginia. It is inequitable, and it’s outdated,” said Board of Education member Andy Rotherham during a special meeting Tuesday.

Virginia’s funding formula establishes how much state and local governments must provide to meet the state’s Standards of Quality (SOQ), the requirements that Virginia public schools must meet. The board reviews those standards every two years and proposes changes as necessary, while the General Assembly makes decisions about how much funding divisions should get.

In addition to backing a new funding formula, the board on Tuesday also urged the General Assembly to provide flexible funding for innovative approaches to literacy and math education, require high school students to have an opportunity to make their own academic and career plans and provide funding for a statewide individualized education program system.

Although board members noted that a decision by the General Assembly to provide divisions more flexible funds could allow them to address a range of different needs, member Anne Holton pushed unsuccessfully for the body to recommend a minimum funding commitment from lawmakers.

“Many divisions, the ones that can afford to fund way over the minimum SOQs … their kids are doing okay,” Holton said. “But the divisions that can’t afford to go way above the state and dated minimum SOQs don’t fund over it, and their kids are not doing okay.”

Funding formula

JLARC this summer recommended the General Assembly consider changing the funding formula after finding that Virginia schools receive 14% less state funding than the 50-state average, equal to roughly $1,900 less per student.

Virginia’s current SOQ formula determines funding for divisions by calculating the number of staff they need and then the cost of those staff.

While the Virginia Department of Education said in a Dec. 12 report that the approach worked historically, it said school divisions today are “faced with a myriad of unique student needs.”

“Funding should be allocated by student, recognizing the unique needs of each student rather than using a formula driven by staffing ratios,” the report stated.

On Tuesday, in line with that suggestion, the board recommended policymakers “investigate, model and develop a plan to move to a student-weighted funding formula for purposes of determining the required state and local shares of cost for the Standards of Quality.” Read More

Democrats are again pushing for legislation that would allow local governments to hold referenda on increasing their sales and use tax to pay for school capital projects such as construction and renovations.

The party hopes the effort, which has been tried twice before but defeated by Republicans, will be successful now that Democrats are set to control both the House of Delegates and the Senate following the November elections.

“We think with the change in the dynamics in the House that this bill has a very good chance,” said Sen. Jeremy McPike, D-Prince William, adding that a similar version of the bill passed with bipartisan support last year in the Democratic-controlled Senate before dying in the House.

Under current law, only nine localities can impose a 1% sales tax to fund school construction and renovation projects. They are the counties of Charlotte, Gloucester, Halifax, Henry, Mecklenburg, Northampton, Patrick and Pittsylvania and the city of Danville.

Local governments have control over adjustments to their property tax rates — but aren’t allowed to change the sales tax rate without explicit permission from the General Assembly.

In 2021, Virginia invested nearly $1.3 billion into programs distributing grants and loans for school construction after a survey found over half of Virginia’s schools are more than 50 years old, with replacement costs for each in the millions.

“It’s really about empowering localities to make their own decisions about how they want to fund schools, and this is a new tool in the toolbox,” McPike said.

Lawmakers have already set a “precedent of permitting localities to impose a sales tax increase for school capital projects through the referendum process,” he said, “but what the bill would do is essentially allow all localities to make that choice and figure out if that’s the right fit for their community and their community needs.”

Former Republican Del. James Edmunds, R-Halifax, introduced a bill last session to add Prince Edward County to the list of localities allowed to impose a 1% sales tax for school capital projects. However, a House Finance subcommittee failed to hear the proposal.

In 2019, Edmunds successfully carried legislation to add Halifax County to the list of permitted localities.

Republicans have been reluctant to support changes to the law that could allow the raising of taxes, outgoing Sen. Tommy Norment, R-Williamsburg, told the Mercury last session.

If the legislation can make it out of both chambers, the bills will still require approval by Republican Gov. Glenn Youngkin, who could sign them into law, veto them or suggest changes.

This article was reported and written by the Virginia Mercury, and has been reprinted under a Creative Commons license.

With the last pandemic-era expansions of federal child care aid to states set to end next year, Gov. Glenn Youngkin is proposing to put $448 million into the commonwealth’s early learning and child care system in each of the next two years.

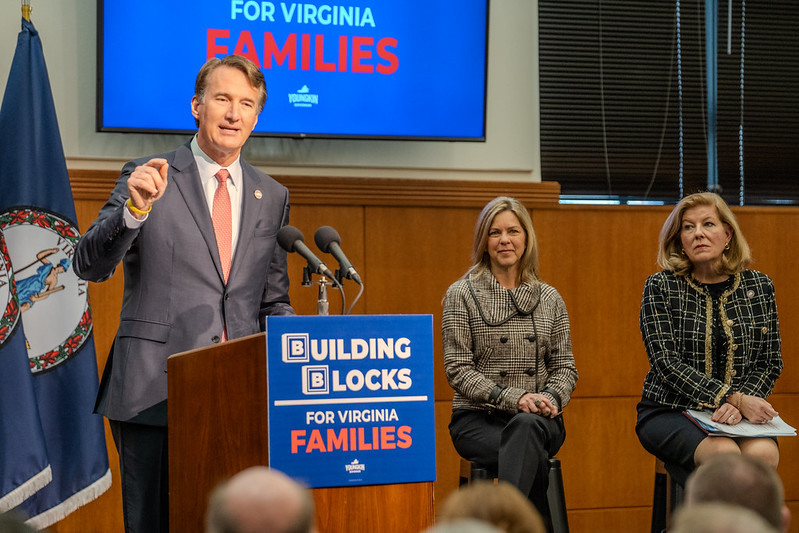

“The reality is that in March 2024, without significant reforms to improve this long-term viability of our child care programs, we would otherwise see children simply being kicked out of these most important collaborations that enable families to realize their dreams and so we can’t leave families, parents and their children without options,” said Youngkin at a press conference for his “Building Blocks for Virginia Families” initiative Thursday.

The funding will be part of Youngkin’s proposal for the state budget over the next two years, which he is scheduled to present to lawmakers Dec. 20. The General Assembly, which Democrats will narrowly control when the session begins this January, will use that proposal as the jumping-off point for their own spending plan.

While the administration has not yet provided a detailed breakdown of how all of the $448 million would be spent, a document provided to reporters includes a list of priorities. They include the desire to “ensure every low-income working family that currently receives public support continues to have access to early childhood and afterschool programs,” “accelerate parent choice, from home-care providers and public school preschools to community co-ops and private day centers,” and require all early childhood programs to “annually measure and report unmet parental demand and preference.”

A few priorities have dollar figures attached: The proposed investment includes $25 million to develop public-private partnerships in areas with child care shortages, $10 million in educator incentives and $1 million to launch early learning and child care accounts on a digital wallet platform for families with children under five. Families can use the wallets to accept funds from such groups as employers, local governments and family members.

Additionally, the plan calls for streamlining teacher licensure requirements and “rightsizing” student-teacher ratios.

“This is about an opportunity for success,” Youngkin said, “and it starts with success for families.”

Kathy Glazer, president of the Virginia Early Childhood Foundation, called the proposal “a remarkable commitment to Virginia’s children and families.”

“By sustaining access to quality, affordable early childhood care and education services, these investments will help unlock the potential of all children and keep Virginia on the path to economic success,” she said in a statement.

An October report by Virginia’s Joint Legislative Audit and Review Commission found approximately 1.1 million children in Virginia aged 12 and younger need child care, and the majority of Virginia families find care to be unaffordable. Read More