The Fairfax County Board of Supervisors has advanced a proposal for a 4-cent real estate tax increase, which would mark the first hike in six years, if approved.

Yesterday (Tuesday), the board gave County Executive Bryan Hill the green light to advertise the fiscal year 2025 proposed budget and schedule a public hearing starting Tuesday, April 16, at 3 p.m.

The public hearing will be held in the board auditorium at the Fairfax County Government Center (12000 Government Center Parkway) over three days, ending on April 18.

Several board members, including Chairman Jeff McKay, acknowledged the necessity of raising tax revenue to pay for employee raises, schools and Metro, among other priorities. However, they noted that the tax rate adopted in the final budget draft may be lower than the advertised rate, which sets a ceiling on what the board can approve.

“It is the prudent thing to do,” McKay said, adding that the board needs flexibility to increase the tax rate if the state does not provide enough funding for specific items, such as schools.

Under the proposed plan, the real estate tax rate would increase from $1.095 per $100 to $1.135, boosting the average tax bill by more than $524. Initially, Hill had recommended a 6 to 8-cent hike, but the board rejected the proposal.

If adopted, the new tax rate would generate an additional $129.28 million in revenue, which would help offset the revenue loss caused by a decline in commercial property values, particularly office space.

About 73% of taxable residential properties in the county saw their value rise this year, compared to just 36% of non-residential parcels, according to the county’s Department of Tax Administration. The average residential property assessment increased by 2.86% to $744,526 from 2023.

Also included in the proposed budget is an 8.8% increase in personal property taxes and a proposed 10-cent-per-pack increase in cigarette taxes, raising the total projected revenue to $363.22 million more than last fiscal year.

The advertised budget largely focuses spending to essential areas like public schools and employee compensation, with nearly half of the funding ($165 million) allocated to Fairfax County Public Schools — falling short of Superintendent Michelle Reid’s request for an additional $254 million.

While board members acknowledged the significance of Reid’s request, several noted during yesterday’s meeting too much of the burden would fall on property owners.

Instead, supervisors blamed the state for failing to adequately fund the school system, pointing out that Virginia’s funding for public education falls well below the national average. They also highlighted Gov. Glenn Youngkin’s proposed state budget, which would reduce funding for K-12 schools.

Springfield District Supervisor Pat Herrity, the lone Republican on the board, said that while he supports the advertised rate, he wants to see the board try to whittle the number down.

“I hope we can start looking at a deep dive on the budget and see what we can do for our taxpayers,” he said.

In addition to testifying at next month’s public hearings, community members can provide feedback to the county on the proposed budget and tax rate online, by text, phone and email.

A final budget and tax rate will be adopted by the board on May 7.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

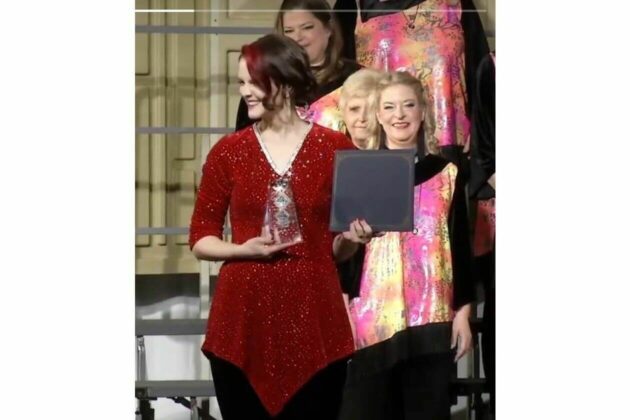

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Pedal with Petals Family Bike Ride

Join us on Saturday, May 11th and ride into spring during our Pedal with Petals Family Bike Ride. Back for its second year, Pedal with Petals is going to be bigger than ever. This year’s event will include both an

Encore Creativity for Older Adults at Capital One Hall

Encore Creativity for Older Adults is pleased to raise the curtain and welcome community members to its spring concert at Capital One Hall in Tysons, VA on May 4, 2024. The concert, which starts at 3 PM, will bring hundreds