On average, Fairfax County residential property owners will see a bigger hike in their tax bills this year than at any other point in the 21st century.

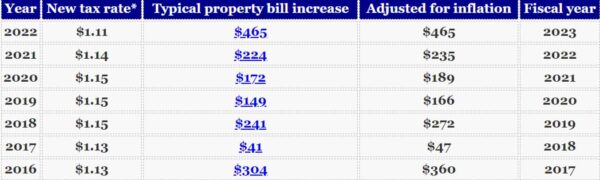

Based on a real estate tax rate three cents lower than what was originally advertised, the average increase of $465 will come once the Board of Supervisors officially adopts a budget on May 10 for fiscal year 2023, which starts July 1.

The spending plan calls for numerous compensation increases, as the county government struggles to fill worker vacancies, along with funding for other initiatives, such as affordable housing and county parks.

At a meeting yesterday (Tuesday), the board agreed 9-1 on a set of adjustments to the proposed budget that County Executive Bryan Hill presented in February. Springfield District Supervisor Pat Herrity, the lone Republican, dissented, saying that he supports the planned employee raises but feels costs could’ve been cut elsewhere.

“This is not a budget I can support given the very realistic options to bring down the rate much further,” Herrity said. “We need…to get back to reviewing programs for effectiveness and some for elimination.”

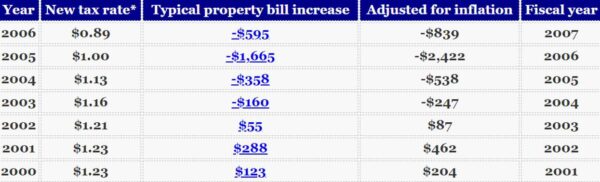

He said the upcoming budget includes the most significant increase in real estate taxes since 2006, when the board dropped the tax rate 11 cents and kept it flat at 89 cents in 2007 as the county sought to move past the housing bubble and financial crisis.

As consideration items for the budget mark-up, Herrity proposed eliminating $81.3 million from the county’s funds for Fairfax County Public Schools and a “$96.4 million surplus…to reduce the taxpayer burden,” among other cuts.

Braddock District Supervisor James Walkinshaw, responding to Herrity’s comments, said the average tax bill is increasing less than inflation. That consumer rate was 8.5%, as of March, over the last 12 months, whereas the average residential property tax rate increase would be 6.7%.

In other budget years, the average bill has increased anywhere from $19 to $360 in today’s dollars. Among those increases, property owners typically face $170 upticks on average, adjusted for inflation.

But the county has also had six budget years in the past two decades where the average bill decreased anywhere from $8 to $2,422 in today’s dollars.

Board members repeatedly referred to the budget’s spending plan as an investment.

“You can starve a community by not investing in it, and I’ve seen it happen across the Rust Belt,” Dranesville District John Foust said. “I can see what happens when you don’t make the type of investments that this board is committed to making.”

Foust said they listened to hundreds of people over its three days of budget hearings, and the budget reflects the priorities of what the community requested.

Providence District Supervisor Dalia Palchik said the rising cost of living is being driven not by taxes, but by factors outside of the county’s control, including the limited available supply of housing.

Chairman Jeff McKay said the budget balances “much-needed services in the county and investments in our public employees and an understanding of the financial strain that soaring-high assessments, soaring car values, inflation and other things that are affecting residents of our community.”

“We know that we’re not entirely out of the woods of the pandemic that has caused so many significant impacts,” McKay said. “But we know that because of investments we have made to help our community get through the pandemic, we find ourselves…in a caution point but also in a strong economy.”