This is a sponsored column by attorneys John Berry and Kimberly Berry of Berry & Berry, PLLC, an employment and labor law firm located in Northern Virginia that specializes in federal employee, security clearance, retirement and private sector employee matters.

By John V. Berry, Esq

Financial issues are one of the most common security concerns for security clearance holders or applicants. When facing financial issues, it is important to be proactive in attempting to rectify them before they become a reason for the loss of a security clearance. When you run into these issues, it is important to hire a security clearance lawyer to advise you.

Financial issues are often called “Guideline F” cases in security clearance cases. In Guideline F cases, the Government’s concern involves how a person has handled his or her finances and their vulnerability to financial manipulation. The criteria for evaluating such cases are covered in Security Executive Agent Directive (SEAD 4) (pages 15-16).

Here are 5 tips for security clearance holders or applicants when dealing with financial debts and other issues:

- Remain Current on Debts

This can be easier said than done. Most security clearance clients seek our assistance when they have had multiple bills that are past due, delinquent, in collections or have been charged off. In some cases, the debts have been ignored. In financial cases, the existence of multiple unpaid debts is one of the most common reasons for denying a security clearance. The first step is to quickly work to resolve major debts to avoid security clearance issues.

- Work with Creditors (or at Least Attempt to)

A debt cannot always be paid off in full immediately. Additionally, it can be easy to ignore a creditor, especially where the debt is too high or disputed, but that is not a good idea. Clearance holders or applicants who attempt to resolve a debt are far better off than those who ignore it. Sometimes creditors do not return calls or are unreasonable, but the key is to document all of the steps taken to resolve a debt. Even where a creditor is unwilling to respond or resolve matters, this can be very important. It is often the case that a creditor will settle a debt with an individual. Clearance holders or applicants should attempt to work with creditors where possible to resolve their debts. All documentation about such efforts should be retained for possible use later.

- Stay Current with Taxes

Clearance holders in tax trouble or who fail to pay and/or file their taxes take a major risk in losing their security clearance. This risk increases if the issue affects multiple tax years. Tax issues are viewed more significantly for security clearance purposes because they are debts owed to the Government. The Government focuses on both taxes owed and whether or not tax filings were completed on time.

If outstanding taxes or tax liens are too much for the individual to pay off all at once, it is important to try to work out a resolution with the IRS or state/county tax agency. All efforts showing good faith work to resolve tax issues can be helpful if a security clearance issue arises. We often recommend involving a tax attorney or accountant, depending on the severity of the tax issues.

- Report Major Financial Issues to Security Officers

If major financial issues arise, it can be important to report them, in advance, to an individual’s security officer. Doing so in appropriate situations can be used as evidence of mitigation for these security concerns. For example, if a bankruptcy arises, it is important to report that to a security officer. If a clearance holder needs to report a financial issue they should consult with counsel immediately to determine the best course of action.

- Show Financial Stability

When financial security concerns arise, it is helpful for security clearance holders and applicants to show that their finances are being managed well. It is important to show that the individual has a budget, lives within their means, and has a plan for paying off major debts.

Contact Us

When facing financial security concerns it is important to consult with a security clearance lawyer. If you need assistance with a security clearance issue, please contact our office at 703-668-0070 or at www.berrylegal.com to schedule a consultation.

Recent Stories

We’re about a month out from summer. That means you’ve still got time for spring cleaning!

Lexi Grant, an operations manager at Well-Paid Maids, shared her go-to spring cleaning tips with WTOP News. Step one? Declutter. Get rid of items you don’t use, find space for items that need a home and organize those areas.

Then, it’s time to dust. Lexi starts with high-touch surface areas (think: refrigerator, dishwasher, counters, microwave). One area she sees often neglected is the bedroom — and it makes sense. Heavy furniture is difficult to move around, but it’s important to really get in there so dust doesn’t affect your sleep.

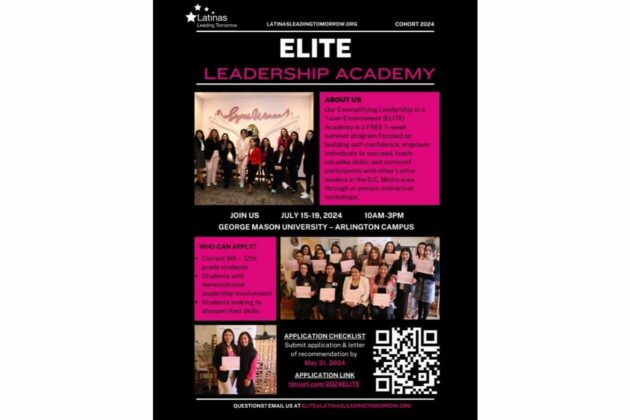

FREE Leadership Sessions will be conducted at the George Mason University –Arlington Campus for High School Latinas. The program runs from Monday 7/15 through Friday 7/19 from 10:00AM to 3:00PM EST each day (1-week).

Las sesiones de liderazgo GRATUITAS se llevarán a cabo en el campus de George Mason University – Arlington para latinas de secundaria. El programa se desarrollará desde el lunes 15 de julio hasta el viernes 19 de julio, de 10:00 a.m. a 3:00 p.m. EST cada día (1 semana).

Our goal is to equip students with the fundamentals of self-promotion and guide them in shaping their personal brand for future success. What sets this program apart is its integration of self-awareness activities and mentorship by seasoned professionals.

Sessions begin with a thorough assessment of leadership dynamics on July 15th, participants delve into the intricacies of personal branding and etiquette on July 16th, followed by practical guidance on crafting compelling LinkedIn profiles and resumes on July 17th. July 18th emphasizes the art of storytelling through personal statements, while July 19th culminates in portfolio presentations, allowing participants to showcase their newfound skills. The program concludes on July 20th with a memorable graduation ceremony, celebrating the accomplishments of the ELITE Academy’s graduates and their journey towards leadership excellence.

Reclaim Your Health Holistically! Vienna, VA

This live local wellness workshop offers everyone a great occasion to discover how to implement natural safe effective solutions for all ages and stages. It is also a great opportunity to continue to celebrate the mamas in your life during

Air Layering: Propagating Difficult to Root Plants

Air Layering Workshop: Propagating Difficult-to-Root Plants

Sunday, May 19, 2024

1:00-3:00pm