As anticipated, Fairfax County is looking at a tight budget for the coming year that will once again lean primarily on residential property owners to offset a declining commercial tax base.

County Executive Bryan Hill has proposed a 4-cent increase in the real estate tax rate, even as he presented an advertised fiscal year 2025 budget to the Fairfax County Board of Supervisors yesterday (Tuesday) that largely limits spending to obligations like public schools and employee compensation.

If adopted, this would be the county’s first real estate tax rate increase in six years, Hill said in a message to the board. Last year, Hill proposed a flat tax rate that the board ultimately reduced by 1.5 cents to $1.095 per $100 of assessed value, though property owners still saw their bills go up by $412, on average, due to rising home values.

The proposed tax rate of $1.135 per $100 for FY 2025, which starts on July 1, would raise the average tax bill by just over $524 and generate $129.28 million in revenue, according to the county.

“We are seeing some residential growth, but our commercial values have declined, resulting in an overall real estate growth of just over 2.7%,” Hill said. “Paired with significant expenditure pressures — particularly for employee pay and benefits, transportation requirements, and continued inflationary impacts — balancing this proposed budget has required difficult decisions.”

Home values up, commercial values down

Real estate tax revenue provides about 66% of the county’s general funds, which supports most county operations, from public safety agencies to libraries and parks. For FY 2025, more than three-quarters of that revenue (76.7%) will come from residential owners, who are facing an average assessment increase of 2.86% for 2024.

Though the number of home sales in the county last year declined, prices have continued to climb “due to low inventory,” Hill said. The average value of the county’s over 357,000 taxable residential properties for 2024 is $744,526, up from $723,825 in 2023.

By contrast, non-residential property values have dropped for the first time in three years by 1.24%, a dip mostly driven by a struggling office market. About 21.6 million square feet, or 17.2%, of the county’s 119.5 million square feet of office space is vacant — an uptick from last year’s rate of 16.7%, which was already a 10-year high.

With another 1 million square feet of office space under construction, mostly in Metro’s Silver Line corridor, the pressure to revitalize or replace under-utilized office buildings will likely only intensify going forward.

“That space is going to be snapped up quickly, which is going to create situations around our county that will be then vacant,” Hill said when asked by Franconia District Supervisor Rodney Lusk about possible remedies. “We have to figure out ways to fill those spaces, whether it is converting or doing something different on that plot of land. We have done a pretty good job in certain areas of revitalizing…but we need to do more.”

Schools and compensation dominate spending

With some growth projected from other sources, including an 8.8% increase in personal property taxes and a proposed 10-cent-per-pack increase in taxes on cigarettes, the county anticipates getting $363.22 million more in revenue than it did this budget year.

However, Hill says he proposed spending only on “adjustments which I feel are essential to maintain the quality workforce and dependable services upon which our residents rely.” Read More

Fairfax County Public Schools is stepping up its requests for funding this year from both local and state leaders.

The school system is seeking an additional $254 million from Fairfax County for fiscal year 2025 — about 10.5% more than last year — to help fund a projected $301.8 million, or 8.6%, budget increase, FCPS Superintendent Dr. Michelle Reid reported in a presentation to the school board on Thursday (Feb. 8).

According to Reid, the increase is necessary for FCPS to meet the needs of all its students and adequately compensate its staff, even though student enrollment remains below pre-pandemic levels and no new initiatives are included in the proposed $3.8 billion budget.

With the county government bracing for a tight budget year itself, Reid stressed that the local request could be reduced if Virginia contributes more than the $42.2 million increase currently expected based on Gov. Glenn Youngkin’s proposed funding plan for the state.

“What I’m presenting…is what I believe we need to resource and sustain the excellent work that our staff are doing today and compensate our staff into the future to keep us competitive, with the hope that as our General Assembly deliberates…they’ll see the necessity of actually allocating a greater amount of state funding, which will help us out in terms of our county transfer,” Reid told the school board.

The disparity between the local and state funding for public education has long frustrated both county and FCPS leaders, who argue that the formula used to calculate funding needs for each school division is outdated and shortchanges Fairfax County — one of the wealthiest counties in the Commonwealth, but also its biggest and most populous.

Those grievances got validated last year when the Joint Legislative Audit and Review Commission released an anticipated study that found Virginia spends about $1,900 less per student than the national average, falling below nearby states like Maryland, West Virginia and Kentucky.

If the Commonwealth matched the 50-state average, it would allocate $345 million to FCPS, according to Reid.

“So, just funding us at the average would be more than what we’re actually asking for in additional funds,” she said.

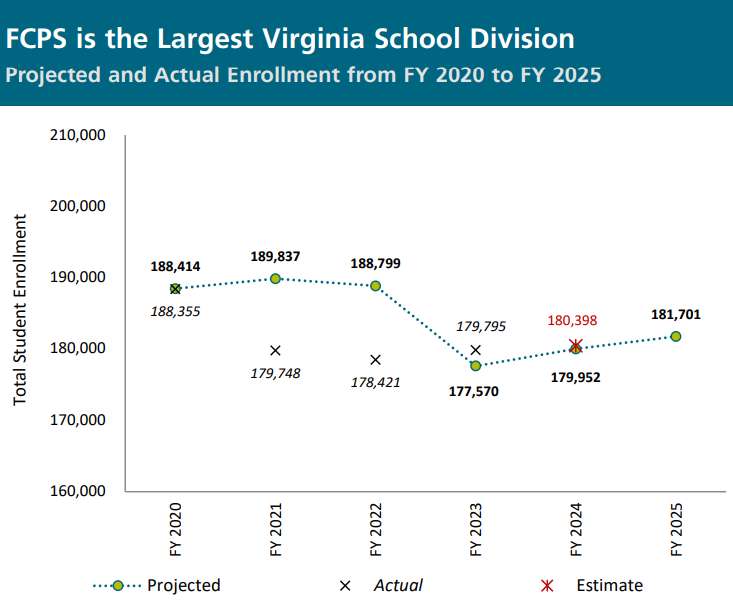

Multiple school board members acknowledged that the size of the funding request may give some community members pause, especially with only a modest growth in enrollment projected for FY 2025, which starts on July 1.

According to the proposed budget, FCPS expects to have 181,701 students next school year. Enrollment has ticked up over the past few years, reaching an estimated 180,398 students this year, but before the COVID-19 pandemic shuttered classrooms in March 2020, the school system had over 188,000 students. Read More

Teacher recruitment, school safety and controlling class sizes have been designated as top priorities for funding by the newly sworn-in Fairfax County School Board.

However, the county’s expected financial constraints may make it challenging for the board’s entire wish list to get funded in the upcoming budget cycle, which will start July 1.

Last week, the school board approved a resolution to serve as a guide for Fairfax County Public Schools Superintendent Dr. Michelle Reid as she crafts the school system’s proposed fiscal year 2025 budget.

The resolution highlights improving teacher compensation, particularly for special education and Title 1 schools, as a key priority. Board members also stressed the importance of increasing access to universal breakfast and lunch programs, reducing school meal debt, expanding preschool options, lowering class sizes, and providing additional funding for mental health and academic support.

While some of those priorities are broad in scope, Mason District School Board Representative Ricardy Anderson noted the board has been discussing these issues with the superintendent and her staff in both public and private meetings for months.

“This is not a surprise,” she said. “They have been part of these conversations, and they understand what the board finds important.”

Aside from Anderson, Braddock District Representative Rachna Sizemore Heizer, and Hunter Mill District Representative Melanie Meren, who supported the resolution, most school board members are newcomers who were not part of the initial discussions on the board’s budget priorities last year.

Despite that, Anderson noted that the new members — all elected in November with Democratic endorsements — have shown strong support for many of the same issues as the previous board, which was similarly all Democratic.

“There was a lot of overlap with what the former board found important and with what the new board finds important,” she said.

Still, there is the hurdle of getting the county on board.

Fairfax County staff told the school board and the Board of Supervisors at a joint meeting last November to prepare for a tough budget year, forecasting a $284.5 million shortfall mainly due to a “flat real estate market,” according to the county website.

At a Nov. 14 school board work session, FCPS Chief Financial Officer Leigh Burden predicted a $202.6 million gap in the revenue needed to fund a 6% salary increase for all FCPS employees, address rising student service demands, and cover inflationary costs.

FCPS has a total operating budget for the current fiscal year of $3.5 billion — a $221.7 million increase from the previous cycle.

The superintendent is set to present her budget proposal to the school board next Tuesday, Feb. 6. How her office will address the revenue gap and incorporate the school board’s priorities into the proposal remains unclear.

However, Anderson said she doesn’t anticipate the school board’s entire wish list will be fulfilled.

“They’re big ticket items, and there’s only so much you can do in any given year,” she said.

Town of Herndon officials estimate a modest influx of general fund revenues in fiscal year 2025 as work begins on preparing the upcoming budget.

At a Herndon Town Council meeting on Jan. 2, Director of Finance Marjorie Sloan said the town expects roughly $41.1 million in general fund revenues — down from $47.6 million in fiscal year 2024, which began on July 1, 2023.

Town council members emphasized the need to find ways to maintain the town’s current level of services, given the overall revenue picture.

“My concern has always been our revenues are not increasing that I think that we need to maintain,” said Councilmember Cesar del Aguila.

Still, Town Manager Bill Ashton II said Herndon is likely “one of the best capitalized localities in Northern Virginia.”

So far, occupancy and meals taxes are “trending favorable” in the budget, according to Sloan. Revenue has also been buoyed by higher-than-average interest rates on investments, and the town is able to shed some costs after deciding to discontinue the Herndon Festival.

Despite the town’s relatively strong cash position, however, high staff turnover — nearly 50% for some positions — remains a challenge.

Councilmember Pradip Dhakal said he’s concerned about the high costs of onboarding new staff and potential implications for turnover in future years.

“50 percent new hires…To me, that’s a little scary, but I think we’re awesome so we can handle it,” del Aguila said.

Tax increases or increases in some town fees may be inevitable, some council members concurred. Still, Sloan said it was important to consider that the current outlook was simply an estimate.

“The bottom line is you can’t always look at the mid-year update and see exactly where we are,” she said.

The council will review a resolution on budgetary guidance at its Jan. 16 meeting. Work sessions on the budget kick off in February — including discussions of a 7% rate increase by Fairfax Water. The proposed budget is scheduled to be publicly released around March 31, followed by the beginning of public hearings on May 9.

At the halfway point of his administration, Virginia Gov. Glenn Youngkin unveiled a budget proposal that calls for significant income tax cuts, increases in state sales and use tax — and a push to get rid of the car tax, which the Republican called “the single most hated tax” in Virginia.

“The car tax belongs in the trash can and not in your mailbox,” he said.

Speaking to the state’s joint money committees Wednesday morning, Youngkin reiterated his familiar themes that Virginia must take action to reverse ongoing population losses to other states and reduce residents’ tax burdens.

“Across the country today, there are winning states and there are losing states,” he said. “Virginia must compete even harder.”

But the governor’s speech took a less political tone than earlier addresses to the state’s legislative budget architects, offering fewer criticisms of prior administrations and acknowledging that Virginia government remains divided after Democrats narrowly won control of both chambers of the legislature this November. That outcome dampened Youngkin’s prospects for a presidential run and will force him to work across the aisle to achieve his key priorities.

Because Virginia operates on a two-year budget that is amended annually, the “Unleashing Opportunity” budget presented by Youngkin Wednesday represents the governor’s first crack at crafting a state spending plan from whole cloth. The last two-year budget, which was passed in 2022, was based on a plan from outgoing Democratic Gov. Ralph Northam.

With power divided between Democrats and Republicans in Richmond and historic state surpluses fueled by pandemic-era relief spending, the past few years have seen unusual levels of contention over the state budget. Amendments to the spending plan, ordinarily passed at the time the General Assembly adjourns in late February or early March, took until September this year to come to fruition as the parties bickered.

“I would ask us to deliver a budget on time when you adjourn sine die in March,” Youngkin told the money committees on Wednesday, referring to the final adjournment of the legislative session. “Virginians deserve it, and I know we can do it.”

This year, lawmakers will have less money at their disposal, with pandemic-era infusions of cash at an end and state economic officials projecting a mild recession beginning in the last quarter of fiscal year 2024.

The “overwhelming consensus” of state leaders, said Youngkin, was that in developing the budget, “we should build in caution.”

Democrats have already signaled concerns with the governor’s spending plan — and some surprise.

“I heard the governor say this was halftime. And he came back out as a Democrat, a lot of tax increases,” wisecracked incoming House Speaker Don Scott, D-Portsmouth, in an exchange with Virginia Secretary of Finance Stephen Cummings.

Senate Democrats on Wednesday afternoon issued a statement calling the governor’s budget “absolutely disgraceful” and “a slap in the face of our most vulnerable individuals.”

“We are smart enough and bold enough to know that his speech was the highlight reel and that he omitted the dirty details of his plan,” the caucus wrote. “Governor Youngkin believes that ensuring more tax cuts for wealthier individuals is most beneficial for low income individuals in our commonwealth.”

The proposal put forward by the governor Wednesday marks only the beginning of the state’s budget season. When the General Assembly convenes Jan. 10, both chambers will have a chance to modify Youngkin’s budget, removing parts they don’t like and accepting or strengthening those they do. The House and Senate will then need to reconcile their two versions of the plan — a process that historically has occurred behind closed doors through the legislature’s opaque conference committee system — and send it to the governor for his review.

“While we appreciate Governor Youngkin for sharing his budgetary vision today, it is imperative that we have a thorough examination of his proposal,” said Del. Luke Torian, D-Prince William, the incoming chair of the House Appropriations Committee. “This is the starting point to construct a budget that not only reflects our dedication, but also secures prosperity and fairness for every resident in the commonwealth.”

Here’s some of what Youngkin is proposing at the starting line. Read More

Local and state officials in Virginia say the path to dig Metro out of its looming $750 million deficit is uncertain — but action is necessary to avoid the significant service cuts, systemwide fare hikes, layoffs and station closures laid out in the transit agency’s newly proposed budget.

Leaders in Fairfax County — which already faces lean economic times — say they don’t plan to offer up additional funds unless jurisdictional and federal partners can throw some more skin into the game.

“What we have said is there’s absolutely no way that local governments can bear the responsibility of that entire bill,” Fairfax County Board of Supervisors Chairman Jeff McKay told FFXnow in an interview before the Washington Metropolitan Area Transit Authority released its official budget proposal.

WMATA has been sounding the alarm on its projected budget shortfall since June.

“What I think you’re going to see happen is there’s going to be some matching and some partnerships,” McKay said.

In a first glimpse of the proposed budget, which was released last Tuesday (Dec. 12), Metro General Manager Randy Clarke laid out what would happen if Metro can’t secure local, state and federal funds to address a problem that has been coalescing for years.

“Metro is facing an unprecedented, existential crisis that requires our region to rally together if we want to avoid the catastrophic impacts this budget would have on our region,” he said.

The system would close at 10 p.m. every day and shutter 10 low-ridership stations. Silver Line trains would turn back at Stadium-Armory, with trains running between Ashburn and that station. Similar reduced turn-backs would take place on the Red Line.

Trains would run every 15 minutes for most stations — a 17 to 67% increase in wait-times across the board on weekdays — and every 20 minutes on weekends for most stations — a 40 to 70% increase. Fares would also jump by 20%.

Among other cuts and more than 2,000 layoffs, Metro would use $193 million from its capital funds to cover operating maintenance expenses — essentially borrowing against the future.

“Such a large transfer of capital funds to operating expenses puts the system’s state of good repair, including safety and reliability, at risk, and threatens to delay, defer, decrease, or cancel several long-term projects to modernize the system,” WMATA cautioned in a press release.

But it’s unclear when and if local and state bodies will offer up enough funding. The subsidized system relies on annual subsidies from Maryland, Virginia and D.C., as well as fare revenue and federal dollars. The fiscal year 2025 budget begins July 1, 2024.

Metro needs subsidy increases of $180 million from Virginia, which has already allocated $348 million. Similar increases are sought from other jurisdictions. The upcoming General Assembly session will determine how much the state is willing to put down to assuage the bleeding after federal COVID-19 funding ends for the system. Read More

The Virginia Board of Education is asking the General Assembly to develop a plan for changing the state’s existing school funding formula to help divisions strapped for money but isn’t backing a proposal to remove a cap that limits the number of support positions the state will fund.

According to an earlier report by the Joint Legislative Audit and Review Commission, which conducts analysis and provides oversight of state agencies on behalf of the General Assembly, changing the formula could help address the underfunding of schools.

“We don’t have a good school financing system in Virginia. It is inequitable, and it’s outdated,” said Board of Education member Andy Rotherham during a special meeting Tuesday.

Virginia’s funding formula establishes how much state and local governments must provide to meet the state’s Standards of Quality (SOQ), the requirements that Virginia public schools must meet. The board reviews those standards every two years and proposes changes as necessary, while the General Assembly makes decisions about how much funding divisions should get.

In addition to backing a new funding formula, the board on Tuesday also urged the General Assembly to provide flexible funding for innovative approaches to literacy and math education, require high school students to have an opportunity to make their own academic and career plans and provide funding for a statewide individualized education program system.

Although board members noted that a decision by the General Assembly to provide divisions more flexible funds could allow them to address a range of different needs, member Anne Holton pushed unsuccessfully for the body to recommend a minimum funding commitment from lawmakers.

“Many divisions, the ones that can afford to fund way over the minimum SOQs … their kids are doing okay,” Holton said. “But the divisions that can’t afford to go way above the state and dated minimum SOQs don’t fund over it, and their kids are not doing okay.”

Funding formula

JLARC this summer recommended the General Assembly consider changing the funding formula after finding that Virginia schools receive 14% less state funding than the 50-state average, equal to roughly $1,900 less per student.

Virginia’s current SOQ formula determines funding for divisions by calculating the number of staff they need and then the cost of those staff.

While the Virginia Department of Education said in a Dec. 12 report that the approach worked historically, it said school divisions today are “faced with a myriad of unique student needs.”

“Funding should be allocated by student, recognizing the unique needs of each student rather than using a formula driven by staffing ratios,” the report stated.

On Tuesday, in line with that suggestion, the board recommended policymakers “investigate, model and develop a plan to move to a student-weighted funding formula for purposes of determining the required state and local shares of cost for the Standards of Quality.” Read More

With the last pandemic-era expansions of federal child care aid to states set to end next year, Gov. Glenn Youngkin is proposing to put $448 million into the commonwealth’s early learning and child care system in each of the next two years.

“The reality is that in March 2024, without significant reforms to improve this long-term viability of our child care programs, we would otherwise see children simply being kicked out of these most important collaborations that enable families to realize their dreams and so we can’t leave families, parents and their children without options,” said Youngkin at a press conference for his “Building Blocks for Virginia Families” initiative Thursday.

The funding will be part of Youngkin’s proposal for the state budget over the next two years, which he is scheduled to present to lawmakers Dec. 20. The General Assembly, which Democrats will narrowly control when the session begins this January, will use that proposal as the jumping-off point for their own spending plan.

While the administration has not yet provided a detailed breakdown of how all of the $448 million would be spent, a document provided to reporters includes a list of priorities. They include the desire to “ensure every low-income working family that currently receives public support continues to have access to early childhood and afterschool programs,” “accelerate parent choice, from home-care providers and public school preschools to community co-ops and private day centers,” and require all early childhood programs to “annually measure and report unmet parental demand and preference.”

A few priorities have dollar figures attached: The proposed investment includes $25 million to develop public-private partnerships in areas with child care shortages, $10 million in educator incentives and $1 million to launch early learning and child care accounts on a digital wallet platform for families with children under five. Families can use the wallets to accept funds from such groups as employers, local governments and family members.

Additionally, the plan calls for streamlining teacher licensure requirements and “rightsizing” student-teacher ratios.

“This is about an opportunity for success,” Youngkin said, “and it starts with success for families.”

Kathy Glazer, president of the Virginia Early Childhood Foundation, called the proposal “a remarkable commitment to Virginia’s children and families.”

“By sustaining access to quality, affordable early childhood care and education services, these investments will help unlock the potential of all children and keep Virginia on the path to economic success,” she said in a statement.

An October report by Virginia’s Joint Legislative Audit and Review Commission found approximately 1.1 million children in Virginia aged 12 and younger need child care, and the majority of Virginia families find care to be unaffordable. Read More

(Updated at 11:25 a.m.) The Fairfax County School Board will vote next week on $847,000 in funding for security cameras at nine elementary schools.

That project is among those that could be funded as part of Fairfax County Public Schools’ midyear budget review, which Chief Financial Officer Leigh Burden presented to the board on Monday (Dec. 4).

FCPS has also proposed allocating $100,000 to cover costs associated with renaming Woodson High School after Carter G. Woodson. The change from former FCPS superintendent W.T. Woodson was approved on Nov. 9 and will take effect with the 2024-2025 school year.

“Historically, renaming costs have typically been about $300,000, but many items at Woodson just say ‘Woodson,’ so those items will not have to be replaced,” Burden said.

The board-authorized funding for security cameras would supplement money the county has received from two Virginia Department of Education grants to fund security cameras at eight elementary schools.

“Prioritization is determined by the building age, the number of existing cameras, the number of incidents at a school location as well as access to uninterrupted power,” Burden said in her presentation.

The elementary schools slated to receive funding through the mid-year budget review are Deer Park, Coates, Springfield Estates, Bull Run, Terra Centre, Greenbriar East, Freedom Hill, Bush Hill and Graham Road.

Another eight schools — Pine Spring, Great Falls, Fort Hunt, Sunrise Valley, Newington Forest, Rose Hill, Forest Edge and Glen Forest — will get cameras through the VDOE grants, which had different criteria for each application, according to an FCPS spokesperson.

When selecting the schools, FCPS considered factors such as the number of students eligible for free and reduced meals, the number of incidents at a given school, when the school was built, the availability of uninterrupted power and how many other schools in each region already had security cameras, the spokesperson told FFXnow.

Superintendent Michelle Reid told the school board in May that about half of the elementary schools in FCPS had exterior video cameras, along with all high schools. Installations at all middle schools were expected to finish this year, and she hoped to expand the program to all elementary schools in the “near future.”

Overall, FCPS has just over $6.1 million in additional funding to allocate in its mid-year budget review, most of which comes from higher-than-anticipated sales tax revenue identified after the end of fiscal year 2023, according to Burden. About $1 million comes from federal Individuals with Disabilities Education Act grants, which support the school operating fund, she said.

The mid-year budget review also includes $88,000 to support restorative justice interventions and $80,000 for improvements to power sources used for Advanced Placement digital testing at select high schools. About $3.1 million would be held for fiscal year 2025, which starts on July 1, 2024.

“We generally like to try to keep the beginning balance around the same level as it is in the previous year because otherwise, if it’s less than that, then that just increases the local request to the county,” Burden said.

Braddock District Representative Megan McLaughlin asked about funding for school maintenance and repairs. She suggested Reid confer with Janice Szymanski, chief of facilities services and capital programs, and her team about addressing some “backlog maintenance issues” ahead of the board’s vote on Dec. 14.

“We just keep telling our communities, in particular our athletic boosters that work hard, tirelessly, year after year to bring money to the table, and then to get told, ‘We’re sorry we promised you that repair project, but there’s no money dedicated to it,’” McLaughlin said. “I think we’re losing faith and support and confidence from our families when we make promises and then we don’t deliver.”

Anticipating slow growth in the real estate tax base and only a modest increase in general fund revenues, local officials are preparing for a slim budget in the next fiscal year.

At a joint meeting on Tuesday (Nov. 28), the Fairfax County Board of Supervisors and the school board got an early forecast of projected revenues, expenditures and general priorities for the county government and public school system’s fiscal year 2025 budgets.

Christina Jackson, the county’s chief financial officer, emphasized that the forecast is an early estimate of the budget.

“We recognize that this was going to be a challenging year,” said Jackson.

County officials anticipate a combined net budgetary shortfall of $284.5 million.

Based on last month’s projections, non-residential tax revenue is expected to grow by 1.9% from the current fiscal year 2024 rate of 3.6%. In fiscal year 2023, non-residential tax revenue stood at 7.3%.

That’s coupled with substantially lower growth in the real estate tax base for next year — a mere 1.7% compared to 6.6% in the current fiscal year. The residential real estate market has softened as a result of high mortgage rates, but values are still expected to increase by 2.1% due to low supply, county staff said.

Funding conversations continue in the background of a study that found Virginia’s school divisions receive 14% less funding from the state than the average for all 50 states.

Calling the state’s underfunding “a generational wrong,” McKay said the report by the Joint Legislative Audit and Review Commission (JLARC) is a critical opportunity to shift the statewide conversation about the state’s funding formulas.

“This study can either collect dust and be ignored, or this study can be acted on and Virginia can get ahead of West Virginia and Kentucky, which frankly should embarrass everyone who lives in Virginia,” McKay said.

Ricardy Anderson, who represents Mason District on the school board and chairs the board’s budget committee, highlighted the space constraints that Fairfax County Public Schools already faces.

“We cannot trailer our way out of this issue, because the schools are growing,” she said, noting that at one school, the entire fifth grade is housed in trailers.

She suggested that the county restart a conversation about adopting a meals tax in order to generate revenue. County voters rejected a referendum in 2016, but the General Assembly approved a bill in 2020 that gave counties the authority to tax food and beverages without a referendum. Read More