The annual vehicle tax that owners pay Fairfax County based on market prices could lighten many drivers’ wallets this year.

Market values from J.D. Power — the price guide used by the county to determine drivers’ bills — indicate vehicle prices are rising an average of over 33%, Young Tarry, director of the county’s Personal Property & Business License Division, told FFXnow.

The market value of used vehicles increased by about 5% last year.

When Fairfax County unveiled its proposed budget for fiscal year 2023 on Tuesday (Feb. 22), Lee District Supervisor Rodney Lusk warned that the pending increases may surprise residents, likening it to the area’s soaring real estate prices.

“My daughter is going to be 16, and we’ve gone out trying to find her a car,” Lusk said. “The crazy thing is — the ones that have excessively high mileage are expensive, and it doesn’t make sense.”

The list price of an average used vehicle is an unprecedented $27,569, as of November 2021, according to Kelley Blue Book. That means an individual’s vehicle tax could increase from last year’s fee of $947 to $1,260.

Lusk says the board could find a way to provide relief for residents, possibly by reducing the vehicle tax rate or providing a discount for the upcoming billing cycle.

“I’m arguing…that we we need to adjust it,” he said Friday (Feb. 25).

Currently, most vehicles pay a rate of $4.57 for each $100 of assessed value. That value is based on a vehicle’s make, model and year as of Jan. 1 each year.

The county bases the assessment on J.D. Power’s “clean trade-in” book value for “a vehicle with no mechanical defects and [that] passes all necessary inspections with ease.” That figure is higher than the listed “average” or “rough” trade-in prices, which can be found at nada.com.

Bills will be mailed starting at the end of July through August, with due dates of Oct. 5.

Assessment appeals to the county can be based on body damage, rusting or high mileage. They must be made within three years of the last day of the tax year the assessment covered.

The possible relief could come from up to $80 million that County Executive Bryan Hill left unallocated for the upcoming budget year.

The county will hold public hearings on the proposed budget on April 12-14. The Board of Supervisors is slated to adopt a spending plan on May 10 before it takes effect on July 1.

Recent Stories

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

There’s a reason Well-Paid Maids has hundreds of positive reviews from happy clients in the D.C. area.

The home cleaning company pays cleaners — who are W-2 employees — a living wage starting at $24 an hour. Plus, cleaners are offered benefits, including insurance, 24 paid days off a year, 100% employer-paid commuting costs and more.

Lexi Grant, an operations manager at Well-Paid Maids, said it best: “People deserve their work to be respected and recognized. When that happens, you love what you do, and you create the best results.”

Dream, Design, Build: Home Expo 2024

Sponsored by ABW Appliances & Eden, join us for a one-of-a-kind Home Expo event on May 11th from 10AM to 4PM!

The DMV’s top experts — AKG Design Studio and GMJ Construction — are opening their doors to homeowners to

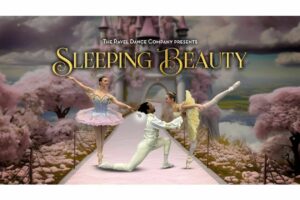

Ravel Dance Company presents The Sleeping Beauty at Capital One…

Be transported to the magical kingdom of Princess Aurora, where the wicked Carabosse casts a curse that dooms the Princess and her entire kingdom. Set to the spectacular Tchaikovsky score, this beloved classic will sweep you away with its beauty,