With property tax assessments skyrocketing, Virginia lawmakers passed a bill this year to change how data centers are valued, which could influence how quickly a local tax district can repay debt for projects that widened Route 28.

The Route 28 Highway Transportation Improvement District’s Fairfax County portion consists of over 1,000 parcels south of the Dulles Toll Road. New assessments for commercial and industrial properties in that area are relatively in line with increases seen in previous years.

Assessed values decreased 4.5% between Jan. 1, 2020 and Jan. 1, 2021 but increased by 3% to nearly $6.6 million on Jan. 1 of this year, according to a staff presentation during a meeting on Friday (March 11) for the Route 28 Transportation Improvement District Commission.

“The main thing we’re at now is just paying off debt,” Fairfax County debt coordinator Joe LaHait said. “There’s no construction left. It’s just paying off debt.”

Over in Loudoun County, however, the total assessed value for around 1,560 commercial and industrial properties in the district shot up by 29.5%, as of Jan. 1.

Officials expect to see assessments decline for properties north of the Dulles Toll Road in Loudoun after the General Assembly adopted House Bill 791, which directs data center valuations to be based on “depreciated reproduction or replacement cost” instead of the income they generate.

The legislative change will take effect on July 1, as long as Gov. Glenn Youngkin doesn’t veto it.

“Based on countywide estimates, Loudoun estimates that the Data Center value could decline by 30% for Tax Year 2023,” a staff presentation stated.

Del. Mark Keam, whose 35th District covers an area ranging from Fair Lakes to Vienna and Tysons, was the chief co-patron of the bill. He didn’t respond to messages seeking comment.

Without the significant increases in data center values, the tax district would generate revenue in line with historical levels, according to staff.

An impact statement for the bill stated there would be no effect on state revenue, but it could result in “an unknown revenue impact to localities.”

Local officials tried to get the bill delayed by a year to understand its effects, but that amendment failed, Loudoun County Board of Supervisors Chair Phyllis Randall, a member of the Route 28 commission, said Friday (March 11).

“We are…in some flux as to knowing what this will look like next year. We know it will decrease, but we don’t know by how much,” Randall said during the commission’s meeting.

She suggested there’s hope that the decrease in valuations won’t be as much as staff projected.

The tax district, which charges 17 cents per $1,000 of assessed value, could finish paying for the completed $105.6 million Route 28 widening projects in 2034 or 2037.

Some local businesses have expressed a desire to not pay the bonds off early, citing benefits of being in the tax district.

Photo via Google Maps

Recent Stories

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

There’s a reason Well-Paid Maids has hundreds of positive reviews from happy clients in the D.C. area.

The home cleaning company pays cleaners — who are W-2 employees — a living wage starting at $24 an hour. Plus, cleaners are offered benefits, including insurance, 24 paid days off a year, 100% employer-paid commuting costs and more.

Lexi Grant, an operations manager at Well-Paid Maids, said it best: “People deserve their work to be respected and recognized. When that happens, you love what you do, and you create the best results.”

Dream, Design, Build: Home Expo 2024

Sponsored by ABW Appliances & Eden, join us for a one-of-a-kind Home Expo event on May 11th from 10AM to 4PM!

The DMV’s top experts — AKG Design Studio and GMJ Construction — are opening their doors to homeowners to

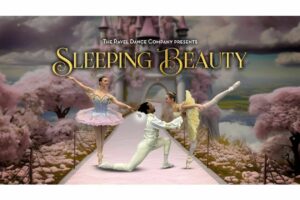

Ravel Dance Company presents The Sleeping Beauty at Capital One…

Be transported to the magical kingdom of Princess Aurora, where the wicked Carabosse casts a curse that dooms the Princess and her entire kingdom. Set to the spectacular Tchaikovsky score, this beloved classic will sweep you away with its beauty,