Fairfax County is again asking the state for money to offset anticipated reductions in resident vehicle tax payments.

At a meeting on Tuesday (Jan. 24), the Board of Supervisors unanimously approved a letter written by Chairman Jeff McKay for Gov. Glenn Youngkin, asking him to include money in his budget for localities to blunt the impact of a 15% decrease in car tax revenue.

“We all heard last year the complaints that came in. I don’t think people understand that we don’t set the value of cars. They are set by others,” Chairman Jeff McKay said. “So, the tool that we had in our toolbox was to automatically put a reduction in value on all those vehicles in the county. Even with that, most people’s…tax bills went up.”

Over the last several years, used car prices have increased dramatically, though they’ve started to come down in recent weeks. Because of that, many county taxpayers are paying significantly more in personal property tax — also known as the “car tax.”

Last year, the Board approved assessing vehicles at only 85% of market value in order to give some relief to county taxpayers. That came after Youngkin signed legislation giving localities express permission to do that, in accordance with the Dillon Rule.

However, the county relies on that money as part of its tax revenue to fund services. In 1998, Virginia passed the Personal Property Tax Relief Act, which dictates that the state should offer car tax relief and subsidize localities for lost revenue owed on the first $20,000 of a vehicle’s value.

But the amount of funding provided to localities hasn’t changed since 2007, and Virginia now provides 20% less relief. In other words, both taxpayers and the county government are getting significantly less money from the state than they did 16 years ago.

After cutting another 15% for fiscal year 2023, which began July 1, 2022, the Fairfax County board is asking to get more money back from the state — a request also made to the governor last year, McKay’s board matter notes.

Youngkin has suggested cutting the car tax entirely, but county officials have expressed some trepidation about the consequences unless the money is reimbursed. McKay said reimbursement might be possible now considering the state’s nearly $2 billion surplus.

“While either the state or county could eliminate car taxes all together, the state should honor its pledge of 1998 to eliminate the car tax while reimbursing local governments for lost revenue,” the letter to Youngkin says. “It is essential and possible, particularly as the state currently sits on a significant surplus, to allocate adequate funding to provide residents with effective personal property tax relief.”

Braddock District Supervisor James Walkinshaw argued that the state can’t truly claim to have a surplus until “the Commonwealth pays its bills…and this is an example.”

“If it doesn’t happen this year with the surplus that exists, it ain’t going to happen next year or the year after that,” he said.

While the governor already released his budget last month, amendments — including one to offset lost vehicle tax revenue — could still happen at the direction of the General Assembly.

Recent Stories

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

There’s a reason Well-Paid Maids has hundreds of positive reviews from happy clients in the D.C. area.

The home cleaning company pays cleaners — who are W-2 employees — a living wage starting at $24 an hour. Plus, cleaners are offered benefits, including insurance, 24 paid days off a year, 100% employer-paid commuting costs and more.

Lexi Grant, an operations manager at Well-Paid Maids, said it best: “People deserve their work to be respected and recognized. When that happens, you love what you do, and you create the best results.”

Dream, Design, Build: Home Expo 2024

Sponsored by ABW Appliances & Eden, join us for a one-of-a-kind Home Expo event on May 11th from 10AM to 4PM!

The DMV’s top experts — AKG Design Studio and GMJ Construction — are opening their doors to homeowners to

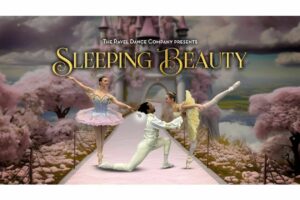

Ravel Dance Company presents The Sleeping Beauty at Capital One…

Be transported to the magical kingdom of Princess Aurora, where the wicked Carabosse casts a curse that dooms the Princess and her entire kingdom. Set to the spectacular Tchaikovsky score, this beloved classic will sweep you away with its beauty,