A Vienna couple who own multiple restaurants in the D.C. area, including Divan in McLean, pleaded guilty in federal court earlier this week to evading over $1 million in taxes and stealing COVID-19 relief funds.

As part of the plea agreement, Gholam Kowkabi, 63, and Karen Kowkabi, 64, will give the IRS the $1.35 million that they failed to pay in taxes related to their D.C. restaurants Ristorante Piccolo, Catch 15 and Tuscana West, the U.S. Attorney’s Office for D.C. announced on Monday (Aug. 14).

Gholam must also pay the Small Business Administration $738,657 in restitution for spending money from Covid loans intended to support Ristorante Piccolo on a “waterfront condo in Ocean City, Maryland, as well as personal investments, vacations for his family, and college tuition for his child,” according to the Department of Justice.

Those “personal investments” included Divan, a Persian and Mediterranean restaurant that opened at 1313 Old Chain Bridge Road in December 2021, per the press release.

A general manager for Divan said the restaurant had no comment on the case.

“This defendant robbed a program intended to help fellow restauranteurs and other small business owners who were struggling to stay afloat amid the devastating economic impacts of the COVID-19 pandemic,” U.S. Attorney Matthew Graves said in a statement. “He also created an elaborate scheme to hide assets and play a shell game with the IRS so he could avoid paying the more than one million dollars in taxes that he and his business owed. Our Office will continue to vigorously prosecute such frauds.”

Prosecutors say the Kowkabis admitted to “willfully” avoiding paying federal employment and income taxes and associated penalties from 1998 to 2018 by buying property through a separate entity and falsifying business records of the D.C. restaurants to hide personal purchases.

According to the DOJ, Gholam also obtained over $1.6 million in federal COVID-19 relief funds from May 13, 2020 to July 27, 2021 that businesses could use to cover payroll costs, rent and other expenses.

In these applications and loan agreements, Gholam Kowkabi fraudulently and falsely promised that the PPP, EIDL, and RRF proceeds would be used only for business-related and eligible purposes as specified in the applications. Instead, Gholam Kowkabi used a portion of the PPP funds, EIDL funds, and RRF funds for unauthorized purposes and for his own personal enrichment, including the purchase of a waterfront condo in Ocean City, Maryland for more than $500,000, two joint venture investments totaling more than $237,000 for the construction of homes in Great Falls, Virginia, and more than $78,500 to open Divan Restaurant in McLean, Virginia. Gholam Kowkabi spent more than $11,000 of COVID relief funds on his home mortgage, more than $14,000 on vacations, more than $62,000 on personal legal expenses, more than $20,000 on home improvement, and more than $5,500 on college tuition payments.

In addition to paying restitution to the SBA, Gholam has agreed to forfeit the Ocean City condo and the two joint ventures that were used to build the Great Falls homes and open Divan.

He pleaded guilty to wire fraud and tax evasion, which carry financial penalties as well as potential prison sentences totaling 25 years.

Karen Kowkabi pleaded guilty to five counts of willfully failing to pay taxes, a charge that could result in up to one year of jail time and fines.

“Tax evasion and misappropriation of COVID-19 relief funds undermine the integrity of our tax system and harm honest taxpayers,” Kareem Carter, acting special agent in charge of the FBI’s D.C. Field Office, said. “IRS Criminal Investigation remains steadfast in its commitment to upholding tax compliance and pursuing those who attempt to evade their tax responsibilities.”

Sentencing hearings have been scheduled for Dec. 1, 2023.

This isn’t the first time Gholam has faced prison on tax-related charges. In 2006, he was sentenced to 18 months in federal prison for taking at least $2 million in sales taxes from D.C., becoming the first person convicted under the District’s then-new law imposing jail time for sales taxes evasion, the Washington Times reported at the time.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

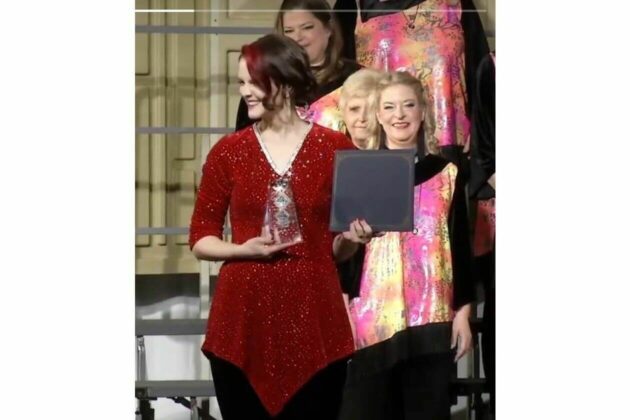

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Pedal with Petals Family Bike Ride

Join us on Saturday, May 11th and ride into spring during our Pedal with Petals Family Bike Ride. Back for its second year, Pedal with Petals is going to be bigger than ever. This year’s event will include both an

Encore Creativity for Older Adults at Capital One Hall

Encore Creativity for Older Adults is pleased to raise the curtain and welcome community members to its spring concert at Capital One Hall in Tysons, VA on May 4, 2024. The concert, which starts at 3 PM, will bring hundreds