A Vienna couple who own multiple restaurants in the D.C. area, including Divan in McLean, pleaded guilty in federal court earlier this week to evading over $1 million in taxes and stealing COVID-19 relief funds.

As part of the plea agreement, Gholam Kowkabi, 63, and Karen Kowkabi, 64, will give the IRS the $1.35 million that they failed to pay in taxes related to their D.C. restaurants Ristorante Piccolo, Catch 15 and Tuscana West, the U.S. Attorney’s Office for D.C. announced on Monday (Aug. 14).

Gholam must also pay the Small Business Administration $738,657 in restitution for spending money from Covid loans intended to support Ristorante Piccolo on a “waterfront condo in Ocean City, Maryland, as well as personal investments, vacations for his family, and college tuition for his child,” according to the Department of Justice.

Those “personal investments” included Divan, a Persian and Mediterranean restaurant that opened at 1313 Old Chain Bridge Road in December 2021, per the press release.

A general manager for Divan said the restaurant had no comment on the case.

“This defendant robbed a program intended to help fellow restauranteurs and other small business owners who were struggling to stay afloat amid the devastating economic impacts of the COVID-19 pandemic,” U.S. Attorney Matthew Graves said in a statement. “He also created an elaborate scheme to hide assets and play a shell game with the IRS so he could avoid paying the more than one million dollars in taxes that he and his business owed. Our Office will continue to vigorously prosecute such frauds.”

Prosecutors say the Kowkabis admitted to “willfully” avoiding paying federal employment and income taxes and associated penalties from 1998 to 2018 by buying property through a separate entity and falsifying business records of the D.C. restaurants to hide personal purchases.

According to the DOJ, Gholam also obtained over $1.6 million in federal COVID-19 relief funds from May 13, 2020 to July 27, 2021 that businesses could use to cover payroll costs, rent and other expenses.

In these applications and loan agreements, Gholam Kowkabi fraudulently and falsely promised that the PPP, EIDL, and RRF proceeds would be used only for business-related and eligible purposes as specified in the applications. Instead, Gholam Kowkabi used a portion of the PPP funds, EIDL funds, and RRF funds for unauthorized purposes and for his own personal enrichment, including the purchase of a waterfront condo in Ocean City, Maryland for more than $500,000, two joint venture investments totaling more than $237,000 for the construction of homes in Great Falls, Virginia, and more than $78,500 to open Divan Restaurant in McLean, Virginia. Gholam Kowkabi spent more than $11,000 of COVID relief funds on his home mortgage, more than $14,000 on vacations, more than $62,000 on personal legal expenses, more than $20,000 on home improvement, and more than $5,500 on college tuition payments.

In addition to paying restitution to the SBA, Gholam has agreed to forfeit the Ocean City condo and the two joint ventures that were used to build the Great Falls homes and open Divan.

He pleaded guilty to wire fraud and tax evasion, which carry financial penalties as well as potential prison sentences totaling 25 years.

Karen Kowkabi pleaded guilty to five counts of willfully failing to pay taxes, a charge that could result in up to one year of jail time and fines.

“Tax evasion and misappropriation of COVID-19 relief funds undermine the integrity of our tax system and harm honest taxpayers,” Kareem Carter, acting special agent in charge of the FBI’s D.C. Field Office, said. “IRS Criminal Investigation remains steadfast in its commitment to upholding tax compliance and pursuing those who attempt to evade their tax responsibilities.”

Sentencing hearings have been scheduled for Dec. 1, 2023.

This isn’t the first time Gholam has faced prison on tax-related charges. In 2006, he was sentenced to 18 months in federal prison for taking at least $2 million in sales taxes from D.C., becoming the first person convicted under the District’s then-new law imposing jail time for sales taxes evasion, the Washington Times reported at the time.

Recent Stories

We’re about a month out from summer. That means you’ve still got time for spring cleaning!

Lexi Grant, an operations manager at Well-Paid Maids, shared her go-to spring cleaning tips with WTOP News. Step one? Declutter. Get rid of items you don’t use, find space for items that need a home and organize those areas.

Then, it’s time to dust. Lexi starts with high-touch surface areas (think: refrigerator, dishwasher, counters, microwave). One area she sees often neglected is the bedroom — and it makes sense. Heavy furniture is difficult to move around, but it’s important to really get in there so dust doesn’t affect your sleep.

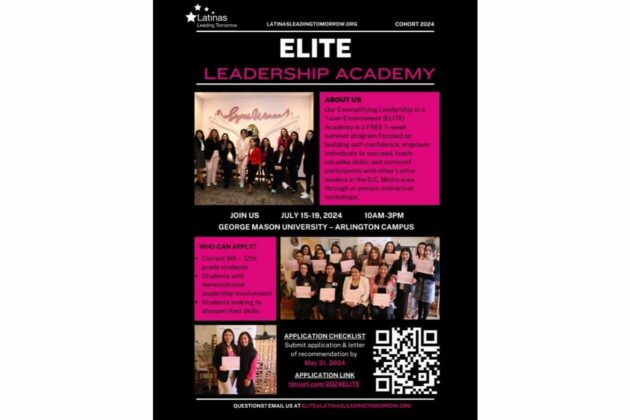

FREE Leadership Sessions will be conducted at the George Mason University –Arlington Campus for High School Latinas. The program runs from Monday 7/15 through Friday 7/19 from 10:00AM to 3:00PM EST each day (1-week).

Las sesiones de liderazgo GRATUITAS se llevarán a cabo en el campus de George Mason University – Arlington para latinas de secundaria. El programa se desarrollará desde el lunes 15 de julio hasta el viernes 19 de julio, de 10:00 a.m. a 3:00 p.m. EST cada día (1 semana).

Our goal is to equip students with the fundamentals of self-promotion and guide them in shaping their personal brand for future success. What sets this program apart is its integration of self-awareness activities and mentorship by seasoned professionals.

Sessions begin with a thorough assessment of leadership dynamics on July 15th, participants delve into the intricacies of personal branding and etiquette on July 16th, followed by practical guidance on crafting compelling LinkedIn profiles and resumes on July 17th. July 18th emphasizes the art of storytelling through personal statements, while July 19th culminates in portfolio presentations, allowing participants to showcase their newfound skills. The program concludes on July 20th with a memorable graduation ceremony, celebrating the accomplishments of the ELITE Academy’s graduates and their journey towards leadership excellence.

Reclaim Your Health Holistically! Vienna, VA

This live local wellness workshop offers everyone a great occasion to discover how to implement natural safe effective solutions for all ages and stages. This event is designed to help you take another step towards reclaiming your health holistically. A

Air Layering: Propagating Difficult to Root Plants

Air Layering Workshop: Propagating Difficult-to-Root Plants

Sunday, May 19, 2024

1:00-3:00pm