As anticipated, Fairfax County is looking at a tight budget for the coming year that will once again lean primarily on residential property owners to offset a declining commercial tax base.

County Executive Bryan Hill has proposed a 4-cent increase in the real estate tax rate, even as he presented an advertised fiscal year 2025 budget to the Fairfax County Board of Supervisors yesterday (Tuesday) that largely limits spending to obligations like public schools and employee compensation.

If adopted, this would be the county’s first real estate tax rate increase in six years, Hill said in a message to the board. Last year, Hill proposed a flat tax rate that the board ultimately reduced by 1.5 cents to $1.095 per $100 of assessed value, though property owners still saw their bills go up by $412, on average, due to rising home values.

The proposed tax rate of $1.135 per $100 for FY 2025, which starts on July 1, would raise the average tax bill by just over $524 and generate $129.28 million in revenue, according to the county.

“We are seeing some residential growth, but our commercial values have declined, resulting in an overall real estate growth of just over 2.7%,” Hill said. “Paired with significant expenditure pressures — particularly for employee pay and benefits, transportation requirements, and continued inflationary impacts — balancing this proposed budget has required difficult decisions.”

Home values up, commercial values down

Real estate tax revenue provides about 66% of the county’s general funds, which supports most county operations, from public safety agencies to libraries and parks. For FY 2025, more than three-quarters of that revenue (76.7%) will come from residential owners, who are facing an average assessment increase of 2.86% for 2024.

Though the number of home sales in the county last year declined, prices have continued to climb “due to low inventory,” Hill said. The average value of the county’s over 357,000 taxable residential properties for 2024 is $744,526, up from $723,825 in 2023.

By contrast, non-residential property values have dropped for the first time in three years by 1.24%, a dip mostly driven by a struggling office market. About 21.6 million square feet, or 17.2%, of the county’s 119.5 million square feet of office space is vacant — an uptick from last year’s rate of 16.7%, which was already a 10-year high.

With another 1 million square feet of office space under construction, mostly in Metro’s Silver Line corridor, the pressure to revitalize or replace under-utilized office buildings will likely only intensify going forward.

“That space is going to be snapped up quickly, which is going to create situations around our county that will be then vacant,” Hill said when asked by Franconia District Supervisor Rodney Lusk about possible remedies. “We have to figure out ways to fill those spaces, whether it is converting or doing something different on that plot of land. We have done a pretty good job in certain areas of revitalizing…but we need to do more.”

Schools and compensation dominate spending

With some growth projected from other sources, including an 8.8% increase in personal property taxes and a proposed 10-cent-per-pack increase in taxes on cigarettes, the county anticipates getting $363.22 million more in revenue than it did this budget year.

However, Hill says he proposed spending only on “adjustments which I feel are essential to maintain the quality workforce and dependable services upon which our residents rely.”

As is typical, nearly half of that funding — $165 million — would go to Fairfax County Public Schools. Though that’s more than the $144 million increase that FCPS got last year, it falls short of the $254 million sought by Superintendent Dr. Michelle Reid, who proposed a 6% salary increase for all employees in a budget plan adopted by the school board earlier this month.

The 10.5% funding increase is the largest that FCPS has requested since fiscal year 2007, and the dollar amount is the highest in the county’s history, according to Hill.

Board of Supervisors Chairman Jeff McKay called the FCPS request “entirely unrealistic,” and Mount Vernon District Supervisor Dan Storck questioned the affordability of even the amount recommended by Hill. At the same time, McKay and other board members made clear that they fault the state more than FCPS for the gap in funding.

A study released last year found that Virginia spends about $1,900 less per student than the national average. Just meeting the average would give FCPS another $345 million, whereas Fairfax County would need to raise its real estate tax rate by another 3 cents to fulfill Reid’s request, according to Hill.

“When you start in the hole as we do, that revenue has to come from somewhere, and it puts a strain on every other thing that we need to do in the county, from public safety to human services to affordable housing,” McKay said. “…In a difficult budget year, it’s very clear what the challenges are and where they begin.”

About 42% of the county’s remaining available funds — $148 million — is targeted for employee compensation, including a 2% market rate adjustment (MRA) for general county workers and the government’s commitments to unionized police and fire employees under collective bargaining agreements approved in December.

Those negotiations led county officials to consider moving away from using market rate adjustments to determine worker pay raises, since calculations can vary from one year to the next, Hill said. Instead, a standard cost-of-living adjustment (COLA) could be used “in future years to provide some predictability for our employees and for budget planning.”

Worker representatives were unimpressed by the proposed compensation, which accounts for 42% of the advertised budget. Tammie Wondong, president of SEIU Virginia 512’s Fairfax County Government Employees Union chapter, said the union is “disappointed” to not see full funding for a 4% MRA.

“Unfortunately, whether it’s an MRA or COLA, the County Executive’s budget proposals fail to keep their promise to employees,” Wondong said. “That’s why we’re organizing and look forward to our union election later this year so we can bargain and lock in fair pay in a collective bargaining agreement.”

Dave Lyons, executive director of the Fairfax Workers Coalition, expressed doubt that the draft budget will be sufficient to address staff shortages and keep the county competitive with other jurisdictions.

“The County needs to do better — and not just in terms of compensation,” Lyons said. “We must make sure our most vulnerable citizens are supported. We need to back our folks in Juvenile Courts, our workers in School Age Childcare (SACC) and those doing the difficult work of Child and Adult Protective Services. Our trades workers — those driving trucks, cranes and picking up our refuse — are increasingly contracted out because not enough county workers can be hired or retained. We’ve got to do better.”

County agencies identify savings

In anticipation of a lean budget, Hill had asked all county agencies to provide options for reducing their budgets by up to 7%, a process that identified $36 million in net savings and 84 positions that could be eliminated without negatively affecting operations or existing employees.

Many of the savings come from getting rid of long-vacant positions and job or program consolidations, but there will be some community impacts. The Department of Neighborhood and Community Services, for example, has proposed closing its Hayfield Secondary School School-Aged Child Care site “due to low utilization,” and Fairfax County Public Library says it can save about $55,000 by adjusting the number of computers at each branch based on their usage and another $10,000 by providing black-and-white printers instead of color ones.

The budget also increases various fees, including for zoning and land development services, senior center memberships and athletic fields and gyms.

Other proposed allocations include:

- $10 million in additional Metro support

- $7.7 million to maintain 72 early childhood education slots that were funded by federal money and staff to support affordable housing efforts

- $3 million for the Fairfax County Park Authority initiatives like mobile nature centers and bamboo removals

- $5.9 million for information technology upgrades

- $1.27 million for General District Court probation counselors and to add support staff for the new Lorton District Police Station

Hill noted that the Metro funding could change depending on the transit agency’s final numbers, which have already been revised from initially dire projections, and any contributions from Virginia. The state Senate gave Metro no new funding in a budget proposal released Sunday (Feb. 18), while the House of Delegates included about $150 million over two years in its draft.

Though no new positions are being added yet, the coming fiscal year will kick off the county’s plan to merge its animal shelter and police protection services, despite objections from the local police union. The advertised budget shifts a position from the Fairfax County Police Department to the Department of Animal Sheltering to create a new chief animal control officer, according to Christina Jackson, the county’s chief financial officer.

“We expect to see more major movement in the FY 2026 budget,” she told the Board of Supervisors.

The board will advertise a ceiling for the FY 2025 tax rate on March 5 and hold public hearings on April 16-18. The budget will be marked up on April 30 and adopted on May 7.

In addition to attending the public hearings, community members can comment online — an option available for the first time in Spanish and Korean — and by phone (703-890-5898, code 1379) and email (FY25Budget@publicinput.com). Comments can also now be texted with the phrase “FY25Budget” to 73224.

Recent Stories

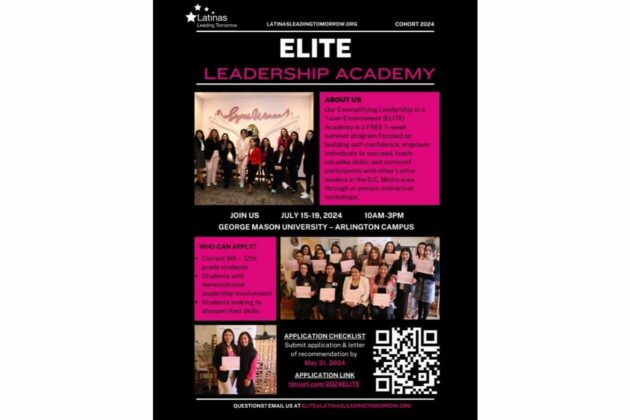

FREE Leadership Sessions will be conducted at the George Mason University –Arlington Campus for High School Latinas. The program runs from Monday 7/15 through Friday 7/19 from 10:00AM to 3:00PM EST each day (1-week).

Las sesiones de liderazgo GRATUITAS se llevarán a cabo en el campus de George Mason University – Arlington para latinas de secundaria. El programa se desarrollará desde el lunes 15 de julio hasta el viernes 19 de julio, de 10:00 a.m. a 3:00 p.m. EST cada día (1 semana).

Our goal is to equip students with the fundamentals of self-promotion and guide them in shaping their personal brand for future success. What sets this program apart is its integration of self-awareness activities and mentorship by seasoned professionals.

Sessions begin with a thorough assessment of leadership dynamics on July 15th, participants delve into the intricacies of personal branding and etiquette on July 16th, followed by practical guidance on crafting compelling LinkedIn profiles and resumes on July 17th. July 18th emphasizes the art of storytelling through personal statements, while July 19th culminates in portfolio presentations, allowing participants to showcase their newfound skills. The program concludes on July 20th with a memorable graduation ceremony, celebrating the accomplishments of the ELITE Academy’s graduates and their journey towards leadership excellence.

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Plus, when you buy a gift certificate from Well-Paid Maids, you’re supporting a living-wage cleaning company. That means cleaners get paid a starting wage of $24 an hour and get access to benefits, like 24 days of PTO and health insurance.

Air Layering: Propagating Difficult to Root Plants

Air Layering Workshop: Propagating Difficult-to-Root Plants

Sunday, May 19, 2024

1:00-3:00pm

Ravel Dance Company presents The Sleeping Beauty at Capital One…

Be transported to the magical kingdom of Princess Aurora, where the wicked Carabosse casts a curse that dooms the Princess and her entire kingdom. Set to the spectacular Tchaikovsky score, this beloved classic will sweep you away with its beauty,