(Updated at 11 a.m. on 2/28/2024) Allegations of racist lending practices against Navy Federal Credit Union have solidified into a class action lawsuit.

Attorneys representing nine members of Navy Federal filed a complaint in federal court on Feb. 20 alleging that the Vienna-based financial institution “systematically discriminates” against people of color, particularly Black, Hispanic and Native American applicants, when determining whether to approve mortgage loans.

The lawsuit builds on a Dec. 14 story by CNN that found Navy Federal was more than twice as likely to reject Black mortgage applicants than their white counterparts, even when they have similar incomes, property values and neighborhood characteristics.

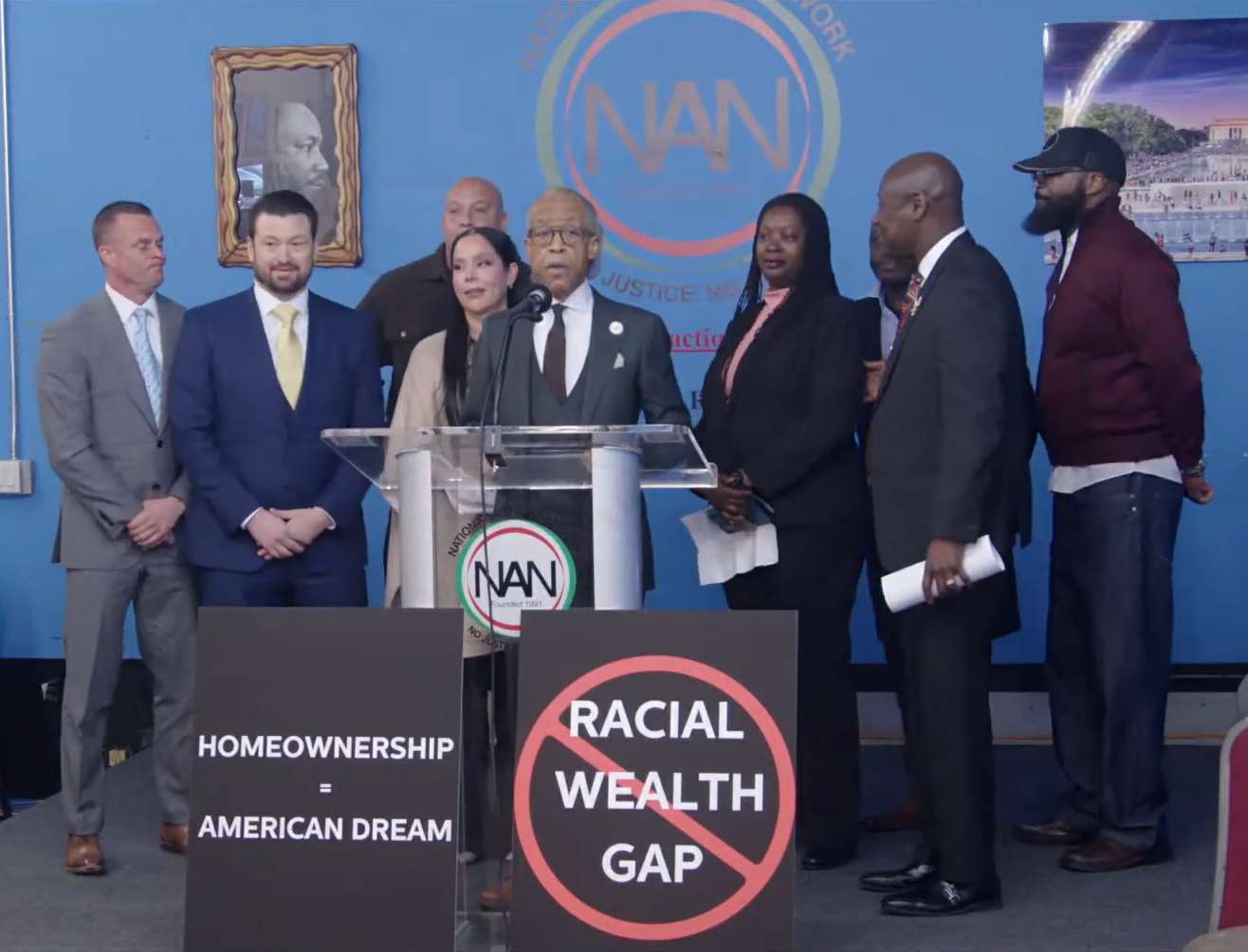

“Navy Federal claims that it champions community and that it is dedicated to embracing and celebrating diversity and inclusion in all the communities it serves. Of course, actions speak louder than words, and Navy Federal’s claims of community devotion ring hollow in the face of its systematic discrimination against non-white borrowers,” civil rights attorney Ben Crump said at a press conference in New York, where the lawsuit was publicly announced.

Consolidating four initially separate legal challenges, the lawsuit was filed in the U.S. District Court of the Eastern District of Virginia in Alexandria, since Navy Federal’s global headquarters are at 820 Follin Lane in Vienna.

Navy Federal, which serves current and former members of the military and their families, gave conventional home purchase mortgage loans to 77% of white applicants in 2022 but only 48% of Black applicants — a 29% disparity that’s the biggest of any major lender in the country, CNN reported, citing data that the credit union was required to report to the Consumer Financial Protection Bureau (CFPB).

Hispanic applicants were approved 56% of the time, while Native Americans and Asians saw approval rates of 64% and 69%, respectively.

Brought by plaintiffs from across the country who say they were either denied a loan or, in one case, issued one at a higher-than-average interest rate by Navy Federal, the 65-page complaint argues that the credit union’s practices amounted to racial discrimination in violation of federal laws, including the Fair Housing Act of 1968, the Equal Credit Opportunity Act, and the Civil Rights Act of 1866.

The complaint also alleges violations of state laws in California and Florida, where some of the plaintiffs are located.

“Harming its members and engaging in unlawful behavior is nothing new to Navy Federal, a company that has shown it simply does not care about equal housing, non-discrimination, or its members’ well-being,” the complaint says, noting that the credit union was ordered by the CFPB in 2016 to pay $23 million to members for making misleading threats in order to collect debts.

In a statement, a spokesperson said Navy Federal has a policy of not commenting on pending litigation, but it will respond to the complaint in “forthcoming” court filings.

As a not-for-profit credit union, Navy Federal is committed to serving each and every one of our members fairly, and we work daily to help expand economic opportunity and access to credit for our diverse community of members. Black borrowers make up one in four of our members, and we are proud of the fact Navy Federal ranks first among large lenders in the percentage of mortgage loans made to Black borrowers. We have robust fair lending programs that perform testing and review policies, procedures, and lending data, which help expand economic opportunity and access to homeownership.

After CNN’s story was published, the credit union announced that it has hired civil rights lawyer Debo Adegbile to conduct a review of its lending policies and practices. It has also created an Office of Financial Opportunity that assists members with finding new economic opportunities.

According to Navy Federal, its own preliminary analysis suggests the gap between white and Black borrowers is less than 1% when considering all of the factors it uses to determine whether to approve home loans, and initial media reports didn’t include the Veterans’ Administration loans that make up half of its loans in their analyses.

Several plaintiffs got emotional when detailing their experiences with Navy Federal at the headquarters of National Action Network, the civil rights organization founded by Rev. Al Sharpton that hosted the press conference on Thursday (Feb. 22).

Bob Otondi, a Kenyan immigrant and Texas resident who was interviewed by CNN for its story, recalled feeling that he’d let his family down when his mortgage application got denied two weeks before he expected to close on a “dream home” in 2021.

For Carl Carr, who served in the Navy from 1982 to 1986, the denial came just two days before closing. Otoni and Carr both later obtained loans from other lenders, but they came at higher interest rates — an experience also shared by Marie Pereda.

A California resident whose husband served in the Marine Corps reserve, Pereda said they lost out on a home they were looking to purchase in 2022 after Navy Federal rejected their mortgage application. The house they ultimately purchased was more expensive, and by the time they found another lender, interest rates had risen.

“These extra monthly costs have caused additional and unnecessary financial strain on our family,” Pereda said. “When Navy Federal denied our application, we couldn’t understand. We were furious, shocked and dumbfounded, but now, it all makes sense. I know now that we weren’t the only ones, and there were others that faced the same discriminatory treatment that we did.”

Christina Jackson, a Navy veteran who sought a loan to pay for improvements to her home in San Diego, California, said getting denied by a bank she’d utilized for over 30 years left her feeling “defeated.” She urged Navy Federal to “come clean and make it right.”

“I lost trust in Navy Federal, and I’m infuriated. I’m upset,” she said. “It was 2021, and now we’re in 2024…When I saw the article with Bob [Otondi], those emotions came back even harder. So, I’m very upset.”

In addition to Crump, who practices in Florida, the plaintiffs are being represented by the D.C.-based law firm Tycko & Zavareei and the Chicago, Illinois, firm Dicello Levitt.

“While a trial date has not been set, the consolidated action is pending in the Eastern District of Virginia, which is well known for having one of the fastest moving dockets in the country,” Wes Griffith, an of counsel with Tycko & Zavareei, said.

This story was updated to correct the spelling of Bob Otondi’s name and Wes Griffith’s position with the law firm Tycko & Zavareei.

Recent Stories

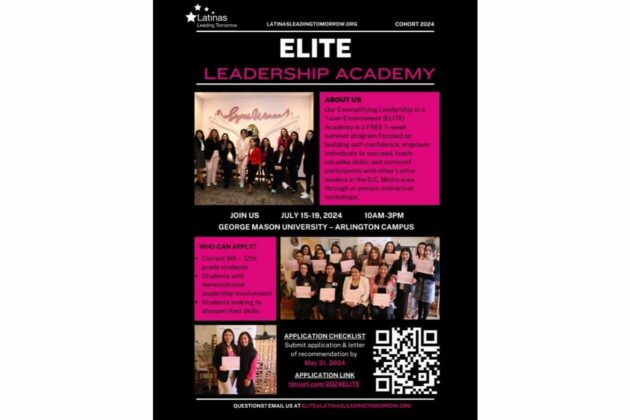

FREE Leadership Sessions will be conducted at the George Mason University –Arlington Campus for High School Latinas. The program runs from Monday 7/15 through Friday 7/19 from 10:00AM to 3:00PM EST each day (1-week).

Las sesiones de liderazgo GRATUITAS se llevarán a cabo en el campus de George Mason University – Arlington para latinas de secundaria. El programa se desarrollará desde el lunes 15 de julio hasta el viernes 19 de julio, de 10:00 a.m. a 3:00 p.m. EST cada día (1 semana).

Our goal is to equip students with the fundamentals of self-promotion and guide them in shaping their personal brand for future success. What sets this program apart is its integration of self-awareness activities and mentorship by seasoned professionals.

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Plus, when you buy a gift certificate from Well-Paid Maids, you’re supporting a living-wage cleaning company. That means cleaners get paid a starting wage of $24 an hour and get access to benefits, like 24 days of PTO and health insurance.

Air Layering: Propagating Difficult to Root Plants

Air Layering Workshop: Propagating Difficult-to-Root Plants

Sunday, May 19, 2024

1:00-3:00pm

Pedal with Petals Family Bike Ride

Join us on Saturday, May 11th and ride into spring during our Pedal with Petals Family Bike Ride. Back for its second year, Pedal with Petals is going to be bigger than ever. This year’s event will include both an