(Updated at 11 a.m. on 2/28/2024) Allegations of racist lending practices against Navy Federal Credit Union have solidified into a class action lawsuit.

Attorneys representing nine members of Navy Federal filed a complaint in federal court on Feb. 20 alleging that the Vienna-based financial institution “systematically discriminates” against people of color, particularly Black, Hispanic and Native American applicants, when determining whether to approve mortgage loans.

The lawsuit builds on a Dec. 14 story by CNN that found Navy Federal was more than twice as likely to reject Black mortgage applicants than their white counterparts, even when they have similar incomes, property values and neighborhood characteristics.

“Navy Federal claims that it champions community and that it is dedicated to embracing and celebrating diversity and inclusion in all the communities it serves. Of course, actions speak louder than words, and Navy Federal’s claims of community devotion ring hollow in the face of its systematic discrimination against non-white borrowers,” civil rights attorney Ben Crump said at a press conference in New York, where the lawsuit was publicly announced.

Consolidating four initially separate legal challenges, the lawsuit was filed in the U.S. District Court of the Eastern District of Virginia in Alexandria, since Navy Federal’s global headquarters are at 820 Follin Lane in Vienna.

Navy Federal, which serves current and former members of the military and their families, gave conventional home purchase mortgage loans to 77% of white applicants in 2022 but only 48% of Black applicants — a 29% disparity that’s the biggest of any major lender in the country, CNN reported, citing data that the credit union was required to report to the Consumer Financial Protection Bureau (CFPB).

Hispanic applicants were approved 56% of the time, while Native Americans and Asians saw approval rates of 64% and 69%, respectively.

Brought by plaintiffs from across the country who say they were either denied a loan or, in one case, issued one at a higher-than-average interest rate by Navy Federal, the 65-page complaint argues that the credit union’s practices amounted to racial discrimination in violation of federal laws, including the Fair Housing Act of 1968, the Equal Credit Opportunity Act, and the Civil Rights Act of 1866.

The complaint also alleges violations of state laws in California and Florida, where some of the plaintiffs are located.

“Harming its members and engaging in unlawful behavior is nothing new to Navy Federal, a company that has shown it simply does not care about equal housing, non-discrimination, or its members’ well-being,” the complaint says, noting that the credit union was ordered by the CFPB in 2016 to pay $23 million to members for making misleading threats in order to collect debts. Read More

The Fairfax County Park Authority wants to know how community members are using its park facilities.

The park authority has launched an equity survey, open through Monday, April 1, as part of its ongoing work to improve access to park programs.

“The Park Authority has intentionally been applying an equity lens to our park system in order to ensure that the accessibility and variety of our program offerings align with the present-day values and interests of our community,” Park Authority Executive Director Jai Cole said. “This latest outreach effort is important to help us identify the barriers that yet need to be overcome such as economic, cultural, transportation and others so that we can continue to make the benefits of parks accessible to everyone.”

The survey asks about the use of parks, rec centers, summer camps, golf courses, nature centers and historical sites. In several cases, respondents have space to explain why they don’t use a given resource. Respondents are asked to provide some personal information, including race, ethnicity and home ZIP code.

“We’re particularly interested in understanding potential barriers that you experience which prevent you from taking full advantage of recreational opportunities,” the survey instructions read.

The survey builds on a recent equity study that found FCPA’s approach to funding some of its programs, including summer camps and rec center memberships, is not consistent with national best practices and is a barrier to their accessibility.

The current model requires fees to cover 100% of both direct program costs, such as equipment, and indirect overhead costs, such as building utilities. In contrast, the median cost recovery from fees across parks and recreation agencies nationally is 25%, and cost recovery typically does not include indirect costs, the study says.

Conducted by the consulting firm HR&A, the study points to greater racial diversity and diversity in household income in Rec-PAC, a recreational program that doesn’t have to recover 100% of its costs, compared to summer camps and other work operating with full cost recovery.

In the case of summer camps, 71% of campers come from households making at least $150,000 per year, even though just 40% of the county’s population meets that income bracket; 69% of summer camp participants are white, compared to 50% of the county’s population.

“These high fees make many programs unaffordable and therefore inaccessible to a large portion of the population, and it hampers the park authority’s ability to provide equitable services,” HR&A Managing Partner Stan Wall told the Fairfax County Board of Supervisors when presenting the study’s initial findings in January.

The equity study includes two main recommendations. First, for an estimated $9.4 million, FCPA could reduce some fees across the board by factoring community benefit into its cost recovery requirement. For instance, children’s swim lessons would not require full cost recovery.

Second, FCPA could offer targeted subsidies to help lower-income households take advantage of recreation programs and resources.

In total, the study estimates it would take $17.2 million to implement a sliding fee scale for certain programs and flexible annual vouchers to cover some recreation expenses for qualified households, including costs for administrative work, outreach and software.

To fund these programs, the county could consider “a dedicated tax stream,” according to the presentation.

“The good news is that many other places have dedicated tax streams for parks and recreation, whether property tax levies or other creative funding streams, and these measures consistently have high levels of voter support,” Wall said.

The equity survey’s results will help inform the FCPA’s recommendations to its board and the Board of Supervisors, which are expected to come this fall.

Amid a docket of new policy proposals, a Virginia Senate panel heard a familiar one Monday when Sen. Jennifer Boysko again presented legislation to require employers to list a wage or salary range in all job postings and prohibit them from asking prospective employees for a salary history.

“This is the eighth time I have introduced this legislation,” Boysko told the Senate Commerce and Labor Committee before vowing to keep reintroducing the measure until it reaches the governor’s desk.

Boysko has pitched Senate Bill 370 as a way to help remedy gender pay gaps by deterring employers from relying on prior salaries to craft future compensation. The idea is that because women in Virginia as a group still make less than men, basing salary offers on past wages could perpetuate those disparities.

“Salary history is often a reflection of past discrimination,” Emily Yen, a lobbyist for the Virginia Education Association, told lawmakers.

Last April, the U.S. Bureau of Labor Statistics reported that in Virginia, the median usual weekly earnings of women who worked full-time were 80% of what their male counterparts received. Full-time workers were considered people who usually worked 35 or more hours per week at their sole or principal job.

Women’s labor advocates have also argued requiring employers to disclose wage or salary ranges provides needed transparency that can dampen inequalities by putting male and female applicants on more equal footing in compensation negotiations.

“When employers negotiate without giving salary range information to job applicants, applicants are more likely to rely on their past pay as a negotiation reference point, which perpetuates existing pay gaps,” wrote the National Women’s Law Center in a brief.

Boysko’s legislation would not prohibit prospective employees from “voluntarily disclosing wage or salary history, including for the purpose of negotiating wages or salary after an initial offer of employment.”

Employers who violated the new rules would be subject to civil penalties of between $1,000 and $4,000, depending on their history of violations, as well as potential damages.

The Senate committee passed Boysko’s legislation on a 9-6 party-line vote after concerns from Republicans about whether the bill offered employers a right to appeal any violation determinations by the state Commissioner of Labor and Industry.

“If you’re having a penalty, you should be able to appeal it to a court,” said Senate Minority Leader Ryan McDougle, R-Hanover.

The bill was amended in committee to outline an appeals process. It now heads to the Senate Finance and Appropriations Committee for review.

Photo via Tim Gouw on Unsplash. This article was reported and written by the Virginia Mercury, and has been reprinted under a Creative Commons license.

Virginia Sen. Tim Kaine is calling on the federal government to investigate whether Navy Federal Credit Union has discriminated when approving loans to homebuyers.

The country’s largest credit union, which is headquartered in Vienna, rejected more than half of the Black people who sought a conventional home purchase mortgage in 2022, despite approving over 75% of white borrowers seeking the same loan, CNN reported last month.

Hispanic applicants also got approved just 56% of the time compared to 77% for their white counterparts, according to the report, which was based on data from the Consumer Financial Protection Bureau (CFPB).

The disparities, which exceed those reported by other major lenders, suggest Navy Federal’s practices may violate prohibitions on discrimination in the Fair Housing Act and the Equal Credit Opportunity Act (ECOA), Kaine and other senators wrote in a Jan. 12 letter urging a review by the CFPB and Department of Housing and Urban Development (HUD).

“While it is appropriate for a lender to deny a mortgage application when the loan will not be sustainable for the borrower, those decisions are made based on a borrower’s financial ability to repay the loan,” the senators said. “It should go without saying that a person’s race, or any other protected characteristic, should never be a factor.”

Founded in 1933 to provide loans to Navy Department employees, Navy Federal has grown to 13 million members and now serves all branches of the military, along with Department of Defense civilians, veterans and their families. The not-for-profit credit union has over 350 branches around the world and employs more than 4,000 people at its headquarters (820 Follin Lane), according to its website.

A spokesperson for Navy Federal Credit Union said the organization has “already initiated a review to assess our mortgage lending policies and practices,” noting that more of its conventional mortgage loans go to Black borrowers — about 18%, per CNN — than most other large lenders.

However, CNN reported that most Black applicants are still getting denied, and the racial disparities persisted even when variables like income, property value and neighborhood characteristics were the same.

“Navy Federal is committed to serving each and every one of our members fairly, and we strive every day to expand economic opportunity and access to credit for our diverse community of members,” the Navy Federal spokesperson said. “…We will continue to work to support all of our members — including Black borrowers — to help them build strong financial futures.”

Homeownership emerged in the post-World War II years as a critical path for accumulating wealth. Over the past 10 years, homeowners have gained anywhere from $98,900 to $150,800 in wealth from rising home values, depending on their income, according to a National Association of Realtors report.

However, Black and Hispanic residents have often been excluded by segregation, redlining and other discriminatory practices, leading to the creation of the 1968 Fair Housing Act, which prohibits discrimination based on race, gender, disability and other identity factors.

The legislation helped narrow the gap between white and Black homeowners, but those gains were erased by the 2008 recession, according to Urban Institute. The Metropolitan Washington Council of Governments announced last week that Fairfax County is among eight localities that have adopted a Regional Fair Housing Plan intended to improve access to housing.

In a press release, Kaine noted that he, fellow Virginia Sen. Mark Warner and other senators introduced legislation last July to reduce the wealth gap by helping first-time, first-generation homebuyers get mortgages.

Image via Google Maps

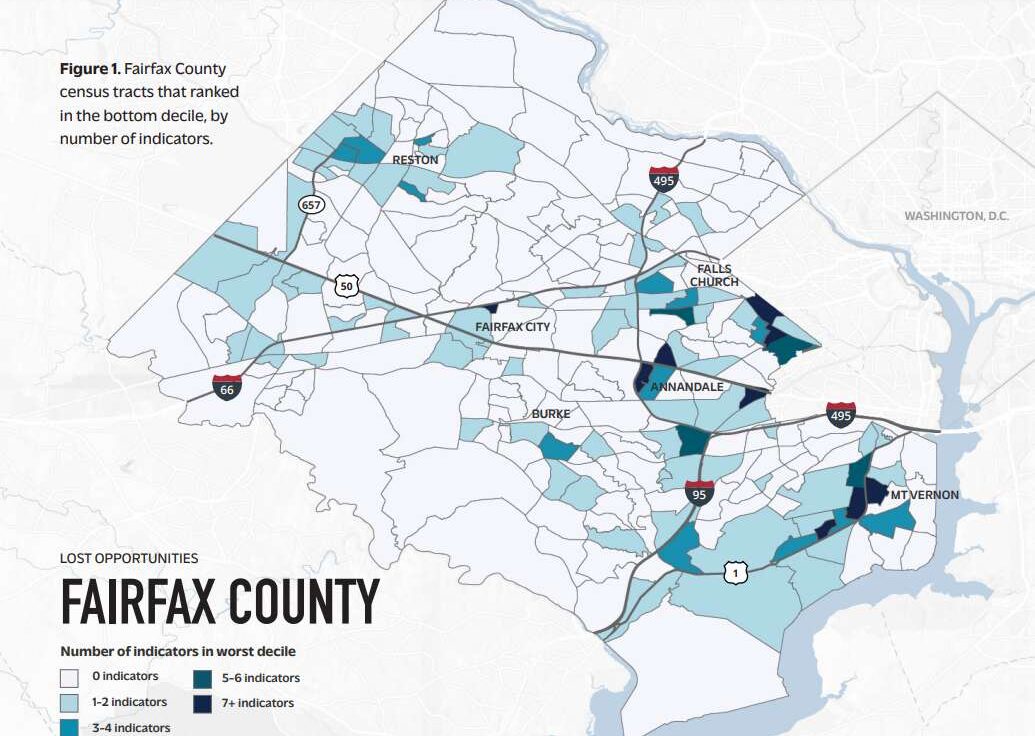

In between the sprawling lawns of Loudoun County and the riverside lofts of Alexandria lie clusters of struggling, predominantly non-white neighborhoods that are increasingly left out of the success and prosperity experienced by Northern Virginia as a whole, recent research notes.

In fact, conditions in some of those neighborhoods — called “islands of disadvantage” — have been in decline for years.

According to a new report by the Center on Society and Health at Virginia Commonwealth University, poverty, rates of people without health insurance, educational attainment, job opportunities and overcrowding all worsened in those neighborhoods between 2013 and 2021.

At the same time, the report notes the economic progress seen in some areas was also accompanied by gentrification and displacement of people of color.

“What is otherwise a healthy and wealthy area is also home to areas of concentrated disadvantage,” said Dr. Steven Woolf, lead author of the VCU report. “This is not something that is widely known, that people are living in deep poverty just a short distance away from the McMansions and golf courses.”

The report, “Lost Opportunities: The Persistence of Disadvantaged Neighborhoods in Northern Virginia,” compares census data from 2009-13 and 2017-21 for Arlington, Fairfax, Loudoun and Prince William counties and the city of Alexandria to understand the social and economic changes the region has experienced over time.

The report, commissioned by the Northern Virginia Health Foundation, builds upon previous research led by Woolf that showed the disproportionate amount of non-white residents that make up struggling neighborhoods experience substantially higher rates of premature death compared to Northern Virginia as a whole.

The latest research found that between 2009-13 and 2017-21, 92% of Northern Virginia census tracts saw an increase in median income, 73% had a rise in residents with a bachelor’s degree and 59% experienced gains in the proportion of adults with a high school diploma. Poverty and uninsured rates decreased in 52% and 78% of the region’s census tracts, respectively.

However, some “islands of disadvantage” experienced opposite trends during those time periods. One section of Bailey’s Crossroads in Fairfax County saw median household income decrease by about $10,000, child poverty rates nearly double to 63% and the overall poverty rate climb to 30%. Read More

The Junior League of Northern Virginia has committed to providing at least 8,000 period products to clients of the Lorton Community Action Center over the next year.

The mission of the Lorton center is to enhance the quality of life for clients by providing food, basic needs, and self-sufficiency programs.

“The Lorton Community Action Center has had a longstanding relationship with the Junior League of Northern Virginia,” said Rob Rutland-Brown, executive director of the center. “We are thrilled that JLNV is stepping into an even more generous role – these donations will ensure that women have access to necessary period products whenever they need them,”

The deepened partnership is part of the Junior League’s new focus: Women Helping Women, a commitment to providing essential services and professional development training opportunities for women and families in the community, according to a news release.

Michelle Freeman, president of the Junior League, noted that statistics show that 20% of women in the Washington area live in poverty.

“Lack of access to period products is often a hidden consequence,” she added. “Our partnership will provide much-needed period products in our local area and really embraces our new focus area.”

Photo via Google Maps. This article was written by FFXnow’s news partner InsideNoVa.com and republished with permission. Sign up for InsideNoVa.com’s free email subscription today.

McLean got a step closer this week to realizing its wish for a new, improved and more inclusive playground at McLean Central Park (1468 Dolley Madison Blvd).

The Fairfax County Park Authority Board approved a $20,000 Mastenbrook Grant Wednesday (Oct. 25) to help fund the project, which has significantly expanded in scope thanks to the advocacy and fundraising efforts of local parents.

The grant brings the total budget up to $442,609 when combined with $246,670 in community donations and $175,939 in previously allocated FCPA funds.

While supportive of this particular renovation, some board members worried that relying on community fundraising to enhance capital projects might create disparities in the quality of park facilities in different parts of the county.

“I fully expect and hope we do approve this tonight, but we still have the question of equity for this kind of thing and this community’s ability to raise this kind of money to build this world-class facility where that’s just not possible in some other places,” Mount Vernon District board member Linwood Gorham said, referencing the $1.5 million conversion of Holladay Field that utilized $725,000 in private contributions.

FCPA staff said they will look at potential policy changes as part of the Parks, Recreation, Open Space and Access (PROSA) Strategy that the board endorsed on Sept. 27. The plan’s goals include consideration of racial and socioeconomic equity when prioritizing projects and services.

Board members emphasized that “nobody did anything wrong with this one,” but they want every community to have access to the level of facilities found in McLean.

“That really should be the standard,” FCPA Director Jai Cole said. “Instead of saying, ‘Why do they get more,’ how do we make sure this is the standard everywhere that we’re going, that we have the means and opportunity to put in a $400,000 playground in parks that are so centrally located like this? It’s a big conversation.”

Ron Kendall, who represents the Mason District, noted that more elaborate facilities also tend to require more extensive and costly maintenance.

“The bigger we build it, the more it’s going to cost for us to keep it in the condition they expect it to be in in that community,” he said. “That is another hurdle that we haven’t discussed much.”

Following a master plan approved in 2013, the park authority acquired $2.2 million from a 2020 parks bond to redevelop the 28-acre McLean Central Park, but that budget only had enough funds to upgrade the school-aged playground, which was installed in 1988 and scheduled to be replaced.

When the FCPA revisited the master plan in 2021, a group of moms urged staff to also renovate the tot lot and relocate the school-aged playground so the two facilites are combined, making it easier for families with kids of different ages to keep an eye on them at the same time. Read More

The Fairfax County Courthouse will soon lend a helping hand to visitors intimidated by the prospect of navigating the legal system on their own.

The county’s new Self Help Resource Center will officially open at 4:30 p.m. on Oct. 5 with a kick-off event in the courthouse law library (4110 Chain Bridge Road, Room 115), the Fairfax Bar Association recently announced.

Supported by $96,000 in county funds, the center will offer free legal assistance and resources to anyone who has to deal with the court, particularly those who are representing themselves either by choice or because they’re unable to hire a lawyer.

“Access to justice for self-represented litigants is a significant issue facing the legal community today,” the Fairfax Bar Association said in a press release. “…Barriers faced by self-represented litigants include cultural and language barriers, procedural hurdles, and general difficulty navigating the court process and understanding legal terminology, from what forms to file, to where and when to appear, and what to say in court.”

The association says it began exploring the possibility of opening a self-help center after the Virginia Access to Justice Commission approved the creation of a pilot program on Dec. 9, 2021.

Created by the Virginia Supreme Court in 2013, the commission found in a 2019 report that the volume of cases where a litigant is representing themselves is high and may be increasing, reflecting general economic challenges and increased online media access.

Surveys of judges and clerks indicated that individuals representing themselves appear to often be low-income and have limited education, according to the report. Judges stated that people generally opted for that approach “because they cannot afford to hire an attorney and cannot obtain representation from legal aid.”

Among other ways to make the court system more transparent and accessible, such as the launch of a self-help website, the report recommended initiating self-help centers staffed by pro bono attorneys or qualified non-attorneys who can provide information about the legal process and court policies and procedures.

Fairfax County’s Self Help Center will be the first one to open in Virginia, according to the office of Franconia District Supervisor Rodney Lusk, who was a top advocate for the facility as chair of the Board of Supervisors’ public safety committee.

Here’s more on the new center from the bar association:

The Fairfax Bar Association in partnership with the Fairfax County Courts, Fairfax Law Library, Legal Services of Northern Virginia, Office of the Fairfax Public Defender, Office of the Fairfax Commonwealth’s Attorney, the Fairfax County Board of Supervisors, particularly the Office of Supervisor Rodney L. Lusk, the Fairfax County Sheriff’s Office, and law firms in Fairfax County collaborated in the creation of a self- help resource center located in the Law Library in the Fairfax County Courthouse Complex.

The Center will be open to the public and available for all individuals who are interacting with the judicial system as litigants, prospective litigants, witnesses, or who simply have business with the court. The Center will serve the large number of self-represented individuals, and would assist them in navigating the court process, providing legal information and forms to allow them to represent themselves in a meaningful way. The Center will serve as an alternative option for those who are unable to afford legal services and for whom pro bono help is not available. The types of assistance provided include the provision of legal information, referrals, forms, and resource materials on topics related to various court matters.

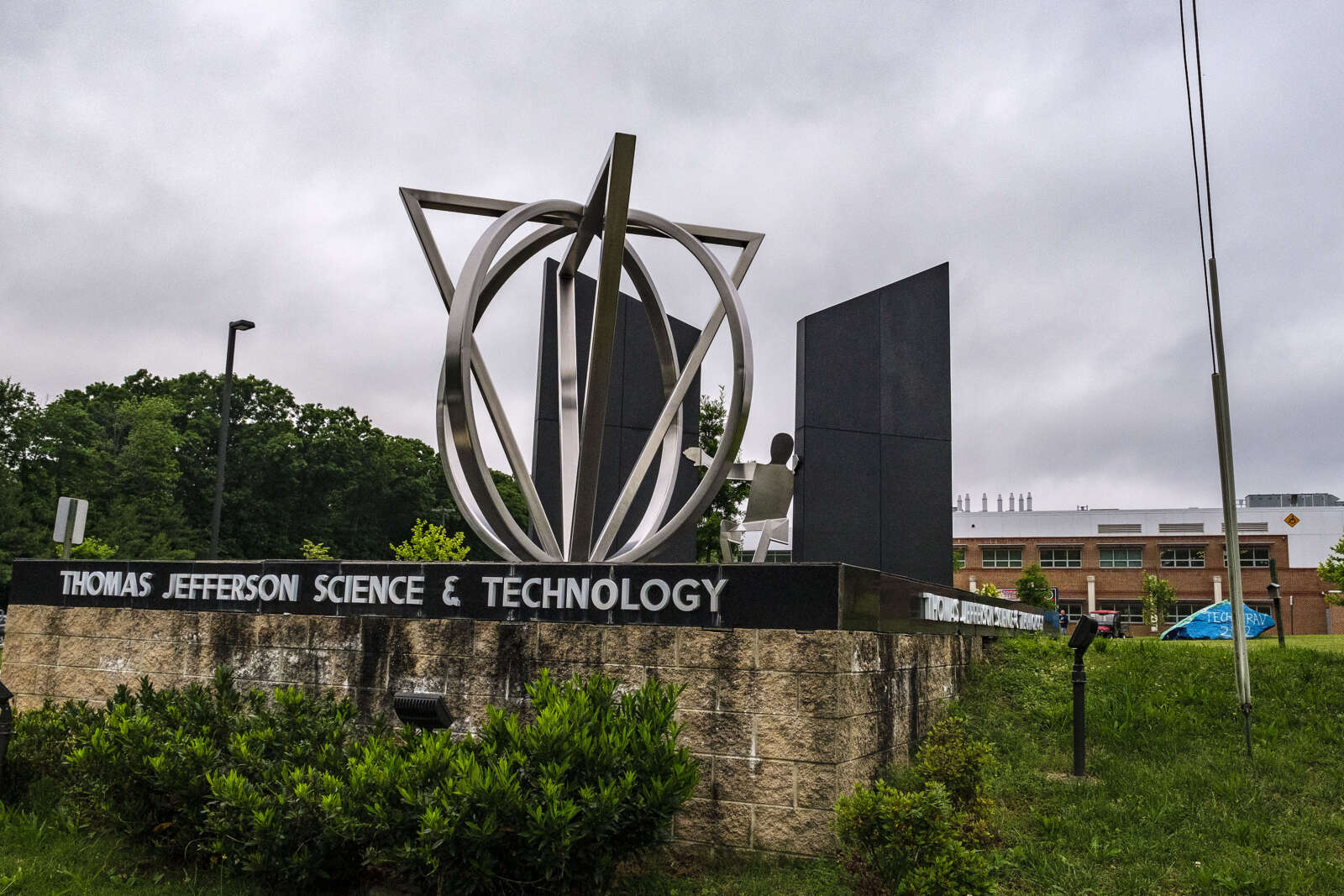

The Coalition for TJ is petitioning the U.S. Supreme Court to consider its lawsuit challenging the constitutionality of Thomas Jefferson High School for Science and Technology’s admissions policy, which was revised in 2020 with the goal of diversifying the student body.

In the petition filed Monday (Aug. 21), the advocacy group argues that the changes approved by the Fairfax County School Board discriminate against Asian students, who saw their share of the magnet school’s incoming classes drop from more than 70% to closer to 60% in the past few years.

The coalition indicated it would take the case to the country’s highest federal court after a Fourth Circuit Court of Appeals panel ruled 2-1 in the school board’s favor on May 23.

But the fight over TJ’s admissions has grown in significance following the Supreme Court’s June 29 decision to prohibit colleges from considering race in admissions decisions. Where that case tackled policies that explicitly take race into account, the Coalition for TJ contends that race-neutral policies designed to boost underrepresented groups can still violate other students’ equal protection rights.

“The Fourth Circuit’s ruling merits this Court’s review because it presents a question of national importance that the Court has yet to answer directly,” Pacific Legal Foundation attorneys representing the coalition wrote in their petition. “Coming as it does on the heels of last Term’s decision curtailing racial discrimination in higher education admissions, this is one of several ongoing challenges to competitive K-12 admissions criteria that seek to accomplish a racial objective ‘indirectly’ because it ‘cannot be done directly.'”

Spurred by student and alumni activism, the school board overhauled the TJ admissions process after Fairfax County Public Schools reported that fewer than 10 Black students had been accepted in both 2019 and 2020.

In addition to eliminating an application fee and rigorous standardized test, the new policy bumped up the GPA requirement to 3.5, granted eligibility to the top 1.5% of eighth graders at each middle school, introduced a “portrait sheet” where students discuss their skills and write a problem-solving essay, and allows consideration of students’ economic status or involvement in English as a Second Language and special education programs.

The changes were the latest attempt to bring more Black, Hispanic and low-income students to TJ, which is often ranked among the top high schools in the U.S. but has long faced scrutiny for admissions practices that critics argued catered to families who could afford to live in certain neighborhoods and pay for private tutoring and test-preparation services.

Since the revised policy took effect in 2021, FCPS has touted increased racial, geographic and economic diversity in each of the three admitted classes, which have all included students from every Fairfax County middle school — something that hadn’t happened in the prior decade.

FCPS has argued that the changes were race-blind and benefitted all groups, including lower-income Asian students. The appeals court judges who sided with the school board said the Coalition for TJ failed to prove that Asian students were “disparately” affected and “that the Board adopted its race-neutral policy with any discriminatory intent.”

FCPS didn’t return a request for comment by press time.

In a joint statement, a collection of civil rights and community advocacy groups — including the Virginia NAACP, TJ Alumni for Racial Justice, CASA Virginia, Hispanic Federation, Hamkae Center and Asian American Youth Leadership Empowerment and Development (AALEAD) — argued that the Coalition for TJ’s lawsuit would limit, rather than expand, equal access to education.

“In essence, the plaintiff seeks to cement pre-existing inequalities by prohibiting school districts from trying to remedy any unfairness in the admissions process that may change the racial makeup of accepted students,” the groups said.

“Every parent wants to know their child will not be disadvantaged in our public education system no matter their personal wealth or language abilities,” Hamkae Center Director Sookyung Oh said. “It is imperative that students from communities of color, including Asian Americans, will not be disadvantaged by an unfair admissions process and will have the same access…only previously afforded to those with the wealth and privilege to get their children into schools like TJ.”

This fall, Fairfax County will launch a guaranteed income pilot program, following in the footsteps of neighbors including Arlington County and Alexandria.

The upcoming Fairfax County Economic Mobility Pilot (FCEMP) will begin providing families with monthly payments totaling $2 million to “promote economic stability and social capital,” according to a press release.

The monthly payments of $750 will go to 180 eligible families chosen via application over the course of 15 months, with the funds being considered untaxable COVID-19 disaster relief that families have the freedom to choose how to spend.

The amount was determined by evaluating the cost of living in the county and the anticipated amount of time necessary to observe and assess the effects of guaranteed income on participants’ lives, a county spokesperson said.

Eligible families will also get access to optional financial coaching from United Way of the National Capital Area‘s Financial Empowerment Center, a partnership with Britepaths and the county, the county spokesperson continued.

“Like other basic income programs, the FCEMP promotes dignity and self-determination by enabling residents to take ownership of their own life and spending decisions,” the county website says.

Eligible applicants must be 18 years or older, have at least one child aged 16 or younger living in their household, and be employed with an income that falls between 150% and 250% of the 2023 Federal Poverty Level. They must also live in one of the following zip codes: 22306, 22309, 20190, 20191, 22041, 20170, 22003, 22150, 20120 or 20151.

The zip codes were chosen by overlaying current Opportunity Neighborhood boundaries and the zip codes they serve with the county’s Vulnerability Index, which analyzes a variety of factors such as race to determine vulnerable areas within the county, a county spokesperson said.

Through the pilot, the county says it hopes the regular payments will result in improved physical and mental health, improved educational outcomes for the children, increased economic stability, higher full-time employment rates, and increased housing and food security.

The pilot specifically aims to help certain households that “earn too much income to be eligible for assistance programs like TANF and SNAP but are struggling to make ends meet or are unable to take financial steps that would allow for economic mobility,” the county says.

As a result, households receiving public assistance benefits, such as Supplemental Security Income or Social Security Disability Income, will not be eligible. However, participants won’t lose their eligibility if they experience any changes in income or public assistance benefits during the pilot.

Supported by a partnership with Beam, a startup that helps administer cash assistance and social safety net programs, the application portal will go live on Sept. 23 and remain open until Oct. 3. Applications will be electronic only, and those selected will be notified via email or text.

The county has also partnered with George Mason University on a study of the pilot. Researchers will collect information from optional personal questions on the application “to understand the impact that unrestricted cash payments have on the economic and social well-being of working households,” the county says.

Participation in the study will not affect an applicant’s likelihood of receiving cash payments.

“Establishing a baseline understanding of families participating in the FCEMP is needed to inform a fully realized program over time,” the county says. “Thus, the FCEMP will measure the economic mobility gains and overall wellness of participants who choose to take part in the research component.”

The FCEMP is authorized by the Board of Supervisors and funded by the county’s general county and American Recovery Plan Act’s Coronavirus State and Local Fiscal Recovery Funds.

Photo via Sharon McCutcheon/Unsplash