The mental health crisis is costing the Northern Virginia region $8 billion a year in unrealized economic output, according to a new report from the Community Foundation for Northern Virginia.

The report from the foundation’s research arm, Insight Region, found that the economic loss caused by mental health has quadrupled since 2019, exacerbated by the COVID-19 pandemic that began in early 2020.

In 2019, worker mental health issues cost the region about 1% in productivity – the equivalent of $2.1 billion – in potential gross regional product (GRP). About 11% of working adults were experiencing mild anxiety or depression in that timeframe.

However, during the pandemic, more than half of all workers reported levels of anxiety or depression. As of May 2023, that statistic held with 53% of the workforce struggling.

The elevated levels of mental health needs caused productivity losses to increase by 2.1 percentage points – or over $8 billion in potential GRP each year, according to the report.

Millions of Americans exited the workforce over the last three years, and one in four blamed their departure on mental health, the report says. That lost employment negatively impacts more than just the worker and their family.

“It also affects team members who must compensate for the lost output; employers who bear the cost of recruiting, hiring, and onboarding new staff; and the local economy in unrealized gross regional product,” the report said.

Most workers with anxiety and depression stay on the job, meaning some of the lost productivity can be attributed to absenteeism and presenteeism – or an employee who is technically on the job but not engaged. This lack of engagement can often result in procrastination and missed deadlines.

Overall, for every worker with a mental health need, their team can expect total productivity to decline by 5% to 13%, or two to five lost hours in a 40-hour work week, according to the report.

“These behaviors can lead to a precipitous decline in productivity, at rates far higher than other conditions,” the report said.

The Community Foundation collaborated on the research with George Mason University. Keith Waters, assistant director at the university’s Center for Regional Analysis, presented the findings [earlier this month] during an event at the foundation’s headquarters in Fairfax.

Waters said the research showed that as mental health issues become more severe, so do productivity losses.

“As you go from sort of no mental health issues to more severe mental health issues, your productivity losses become more severe, you miss work more and then your presenteeism issues become more severe,” he added. Read More

(Updated at 9:05 a.m. on 7/26/2023) Fairfax County is currently the second largest suburban office market in the nation, with an inventory of 120 million square feet.

However, the current office vacancy rate sits at 16.7% — topping the county’s previous 10-year high, according to Stephen Tarditi, director of market intelligence at the Fairfax County Economic Development Authority.

He called the office market “a lagging economic indicator” when presenting the data last Tuesday (July 18) to the Board of Supervisors economic advisory committee.

Despite the county’s vacancy rate, Tarditi said the demand for office leasing is increasing.

“Last year, we had 6.6 million-square-feet of office space leased, so we’re 37% below our pre-pandemic average,” he said. “And comparing that to 2021, we were about 4.5 million square feet.”

Almost half of the county’s office inventory was built before 1990, and Tarditi said the county is seeing a bifurcation in its office market, where older buildings are not being leased at the same rate as newer buildings.

Almost 5.9 million square feet of office space is slated to be demolished or converted into another use, most of it built before 1990, according to the presentation.

“The class B, class C inventory — that’s not seeing your net new tenant demand. It’s your trophy office buildings. In fact, the trophy office vacancy rate for Fairfax County is right around 10%, which is very healthy,” Tarditi said.

According to the data, coworking space is another strong sector in the office market, with demand increasing among more small businesses.

“I think more and more building operators — if there is vacant space and newer buildings — they’re looking to incorporate coworking space and have them graduate in that space,” Tarditi said.

National economic indicators that could have a potential effect on the county’s office market include mass layoffs and interest rates. Although the county is seeing a high vacancy rate, Tarditi highlighted some statistics that could indicate growth in office demand in the future.

Fairfax County now has 42,000 employee establishments (companies with employees and payroll) — a record number for the county, according to Victor Hoskins, CEO of the Fairfax County Economic Development Authority.

“That shows that there would be future office demand as a new company is established,” Tarditi said.

After years of groundwork, the Huntington Club is pausing its plan to terminate itself and delaying major redevelopment plans that would have tied into the nearby Metro station.

On Friday (April 21), the Huntington Club condo association announced it will no longer move to disband this year and has paused construction of a large mixed-use development near the Huntington Metro station.

The condo association acknowledged to the Fairfax County Board of Supervisors in December that it was cash-strapped and needed the county to step in by issuing $45 million worth of bonds to push redevelopment forward.

The county was set to establish a community development authority (CDA) to borrow the needed money. Then, the CDA would pay back the $45 million in bonds through tax increment financing (TIF).

However, there were risks involved, particularly for the condo association and unit owners. The current financial environment convinced the Huntington Club to delay the project for the foreseeable future.

“We have all reached the conclusion that despite everyone’s best efforts, we’re not able to move forward with our redevelopment at this time,” Huntington Club Board of Directors president Lloyd Tucker said in a press release. “For us to terminate our condominium by December 15, as our termination agreement calls for, many pieces would need to be in place that simply cannot happen in today’s financial environment.”

Currently, the community comprises 364 garden and townhome condos on a 19-acre site next to the Metro station. It was set to be transformed into a denser development with 200 stacked townhomes and 1,300 multifamily units. It would also include senior living, office space, a hotel and ground-floor retail.

The redevelopment would have been a major complement to a development plan for the Metro station area, which is already in motion.

Explaining its decision, the club cited the pandemic’s impact on commercial real estate, rising interest rates, and recent bank failures that have combined “to essentially freeze the credit markets.”

“It’s an industry-wide issue at this time,” a spokesperson for the condo association told FFXnow.

In response, a scheduled public hearing on May 9 about the Huntington Central CDA has been canceled and “won’t be rescheduled until the project starts up again,” per the spokesperson.

However, the agreements, rezoning efforts, and plan amendments negotiated with the county for the redevelopment won’t expire, allowing efforts to ramp up again when the financial climate becomes less murky, the condo association said.

Mount Vernon District Supervisor Dan Storck, vice chair of the board’s economic initiatives committee, told FFXnow he still expects the redevelopment to happen at some point.

“Redevelopment of the Huntington Metro station remains a high priority for me, the County and our community as it furthers our goals for transit-oriented development,” Storck said. “We have invested substantial time and due diligence to move this project forward, including planning for special Tax Increment Financing (TIF) to fund public infrastructure for Phase 1 of the project. We look forward to the resubmission of this project as economic conditions improve.” Read More

There has been no shortage of thinkpieces about how the COVID-19 pandemic has changed workplaces, from the waning demand for office space to widespread staffing deficits as workers reevaluated their goals and working conditions.

One trend that may be here to stay is the growing acceptance of remote work, with many people who can telework saying they would do it all or most of the time, if given the option.

While available, detailed data on remote work is limited, about a third of workdays are now being done from home, a decline from the height of office shutdowns in 2020 but well above pre-pandemic levels, The Washington Post reported in August.

According to the Post, remote work has been most prevalent in white-collar sectors, like finance and technology. Northern Virginia, including Fairfax County, is among the places with the highest remote-work rates.

Though many offices have reopened, commuting remains down in the D.C. region. In Virginia, 35.9% of businesses increased telework during the pandemic, and 64.7% of them intend to stick with it after the pandemic, the Northern Virginia Regional Commission says based on federal labor statistics.

Has the pandemic changed where or how you work? If you have the option to work remotely, are you taking advantage of it, or do you prefer going to a physical workplace?

Photo via Clay Banks/Unsplash

Sufficient health care, college degrees, and homeownership are becoming increasingly unattainable for Fairfax County residents with low to moderate incomes, a new report finds.

Late last month, Fairfax County released its “Needs Assessment” study, which comes out every three years with data on the current economic conditions in the county and the impact those conditions have on residents.

The report paints a pretty harrowing picture in light of the pandemic and recent inflation, particularly for lower-income residents. Low to moderate incomes are generally defined as those earning 60% or below the area median income. In 2021, that number was $77,400 for a family of four.

Just in the last year, those living on a limited income are having more trouble affording basic needs, as rising cost-of-living expenses mean lower-income households are spending more than they did in the past.

“Fairfax County residents with moderate to low income may have little to no money remaining after covering essential expenses, such as food and housing,” the report says. “This limits a household’s ability to build savings and restricts economic competitiveness.”

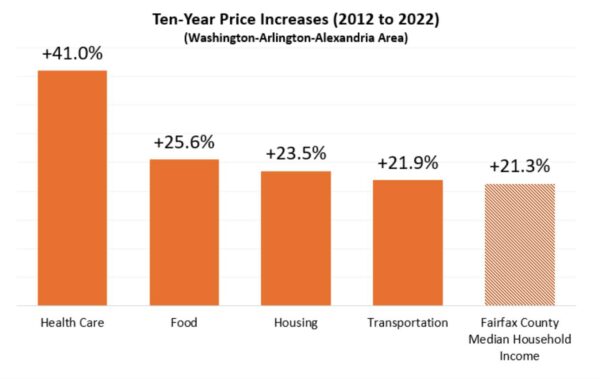

According to the report, household incomes have not kept pace with rising costs of essential expenses over the past decade.

In Fairfax County, the median household income has gone up about 21% since 2012. However, food, housing, and transportation all have risen more in that timeframe. Most notably, health care costs have risen by a whopping 41% in the last decade.

“Longer-term, health care costs have increased the most over 10 years, which may present challenges for residents who do not have health insurance coverage,” the report says.

As a result, the lowest-income households in the county are spending much more on health care, percentage-wise, than other income brackets.

The lowest 20% of households by income are spending nearly 29% of their expenses on health care, while those in the middle are spending between 15% to 17%.

Consumer prices have also gone up more in this past year than at any other point in the previous four decades. Tuition and child care now cost nearly 4% more than last year, housing more than 5%, health care 7%, and food 8%, according to the report. Read More