The Town of Vienna intends to lower its real estate tax rate for a third consecutive year, as home values continue to soar.

Released on Monday (March 6), the town’s proposed budget for fiscal year 2023-2024 — which will begin on July 1 — cuts the real estate tax rate by a quarter of a cent, decreasing it to 20 cents per $100 of a property’s assessed value.

If the proposal is approved, the town will have reduced its property tax rate by 2.25 cents — or 11% — during the pandemic. Cuts were also approved last year and in 2021, which had represented the first rate decrease since 2013.

Even with the quarter-cent rate reduction, however, Vienna homeowners should brace for a big jump in their tax bills.

“The average residential tax bill is estimated at $2,041, an 8.6 percent increase over last year, due to a 10.0 percent increase in assessed value of existing…properties,” Town Manager Mercury Payton said in his budget proposal. “The increase in commercial and residential assessments generates a revenue increase of $884,000 after the real estate tax rate reduction.”

Calculated annually by Fairfax County, this year’s real estate assessments found that the average value of residential properties in Vienna is now slightly over $1 million, with the biggest group falling in the $500,000 to $800,000 range. Residential properties valued at over $1 million, including a few that exceeded $3 million, make up 29.9% of the town’s properties.

With increased revenue also reported from business licenses and the meals and sales taxes, the proposed budget totals $50.1 million — an increase of $1.4 million or 2.9% from the current budget.

Those funds will be used to increase compensation for town employees by 5%, with sworn public safety workers getting an additional 0.5% step increase. The increases are partly intended to assist with rising costs due to inflation, which hit a 40-year high last fiscal year.

Payton has also proposed continuing to offer a $2,000 signing bonus to commercial licensed drivers, an incentive introduced last year to address staffing shortages in the public works department.

“The program is budgeted at $65,000 in the general fund, and has already had a positive impact in recruiting and retaining qualified drivers,” Payton wrote.

The budget adds two full-time staff positions: a senior compliance officer in planning and zoning, and a civil and capital project engineer, who will help manage infrastructure and sidewalk projects while also reviewing single-family housing and commercial redevelopment applications.

To cover some of the salary increases and increased water purchase and sewer treatment costs, the budget proposes increasing water and sewer rates by 10%, raising service charges for residents from $32.80 per quarter to $35.00 per quarter.

The average customer’s bill would go up by $20.25 per quarter, or $80 a year.

“This proposed budget is based on direction from the Town Council early in the process and recommendations from the staff budget committee over the course of the last few months,” Payton said in a news release. “The result is a legally balanced proposed budget that addresses priority operational concerns, and provides continued support for day-to-day operations in all Town departments.”

The Vienna Town Council will discuss the proposed budget in conference sessions on Saturday (March 11) and Monday (March 13) before advertising the package, including tax rates, on March 23. Public hearings are set for April 10 and 24, with a final vote coming on May 15.

The redevelopment of two empty commercial buildings in the Bailey’s Crossroads areas has been approved — along with a nearly $14 million partial tax break from Fairfax County.

At a meeting on Tuesday (Feb. 21), the Fairfax County Board of Supervisors unanimously approved funds for the Skyline project through the county’s Economic Incentive Program, which allows qualifying properties to receive funds in the county’s five Commercial Revitalization Districts (CRDs).

Other CRDs are located in Annandale, McLean, Richmond Highway and Springfield, along with the revitalization area of Lincolnia. The program was designed to provide financial incentives to the private sector on projects that rely on assembling and developing properties.

The project would connect the long-vacant duo of office buildings (5113 and 5111 Leesburg Pike) into up to 510 live-and-work units, ranging from 600 to 1,300 square feet in size.

In a memo, county staff said that the project provides “crucial” affordable housing for families earning from 60 to 80% of the area median income.

Mason District Supervisor Penny Gross said the repurposing of the buildings is an important step to revitalize the area.

“Vacant office buildings don’t enhance community but work-life communities revitalize our community,” she said.

The buildings currently have nine office floors and a penthouse level on top of a three-story parking garage. The connecting building at 5109 Leesburg Pike would remain standing as commercial space.

The shift comes after Skyline buildings one through three received county approval in July and September 2020 for a similar repurposing of office space to up to 720 “live/work” units.

Board of Supervisors Chairman Jeff McKay called the proposal an “excellent” and “creative” use of funds in an area of the county that needs additional support.

(Updated at 11:05 a.m.) The proposed 2024 budget has real estate taxes once again increasing for many, as home values across Fairfax County continue to rise.

At yesterday’s Board of Supervisors meeting, County Executive Bryan Hill presented his proposed fiscal year 2024 budget. The $5.1 billion budget is up $280 million from last year — an increase of about 6%, largely due to real estate taxes going up.

While the budget calls for the tax rate to stay the same as last year at $1.11 per $100 of assessed value, the average bill is set to increase by about $520 for homeowners, thanks to a nearly 7% rise in real estate assessments.

Hill warned in November that assessments were likely to go up, and Board Chairman Jeff McKay told FFXnow last month that he expected real estate taxes to be a big discussion point during the budget debate. But the extent of the increase nonetheless elicited strong reactions from supervisors.

McKay said that, given last year’s numbers, the tax rate is “far too high,” while Springfield District Supervisor Pat Herrity called the increase “unacceptable.” They signaled strong support for finding a way to provide residential tax relief to residents.

The proposed budget includes $90 million in unallocated funds that can be used at the “Board’s consideration.” A huge chunk of this, if not all, could be used to lower residents’ tax burden in some form, as was the case for the current fiscal year 2023.

The county’s budget continues to rely on real estate taxes, more than three-fourths of which come from residential property owners.

Nonresidential real estate values also increased this year, but by less than residential values. This means that real estate taxes make up more of the tax base than in FY 2023, increasing by about 0.75%.

While seemingly a small tick up, Franconia District Supervisor Rodney Lusk said the trend is going in the wrong direction and that commercial real estate taxes should make up at least 25% of the tax base. It currently only makes up just over 16%.

“Clearly, we are off. It’s not good and very disconcerting,” he said. “We need a plan or a strategy to address these issues.”

Hill’s budget plan proposes a $144 million increase in funds provided to Fairfax County Public Schools, which typically gets over 50% of the overall budget. That represents more than a 6% hike from FY 2023, which began on July 1, 2022.

The FY 2024 Advertised Budget proposal includes a 6.3% or $144.1 million increase for @fcpsnews in addition to support for programs like Head Start, school health, behavioral health services, crossing guards, field maintenance and other costs. pic.twitter.com/8cNyztgNbJ

— Fairfax County Government 🇺🇸 (@fairfaxcounty) February 21, 2023

But that number is about $15 million lower than what Superintendent Michelle Reid initially requested.

As expected, the Fairfax County Federation of Teachers doesn’t agree with this proposal, writing in a statement that it “strongly encourages the Board of Supervisors to fully fund the FCPS budget request.” Read More

Fairfax County is again asking the state for money to offset anticipated reductions in resident vehicle tax payments.

At a meeting on Tuesday (Jan. 24), the Board of Supervisors unanimously approved a letter written by Chairman Jeff McKay for Gov. Glenn Youngkin, asking him to include money in his budget for localities to blunt the impact of a 15% decrease in car tax revenue.

“We all heard last year the complaints that came in. I don’t think people understand that we don’t set the value of cars. They are set by others,” Chairman Jeff McKay said. “So, the tool that we had in our toolbox was to automatically put a reduction in value on all those vehicles in the county. Even with that, most people’s…tax bills went up.”

Over the last several years, used car prices have increased dramatically, though they’ve started to come down in recent weeks. Because of that, many county taxpayers are paying significantly more in personal property tax — also known as the “car tax.”

Last year, the Board approved assessing vehicles at only 85% of market value in order to give some relief to county taxpayers. That came after Youngkin signed legislation giving localities express permission to do that, in accordance with the Dillon Rule.

However, the county relies on that money as part of its tax revenue to fund services. In 1998, Virginia passed the Personal Property Tax Relief Act, which dictates that the state should offer car tax relief and subsidize localities for lost revenue owed on the first $20,000 of a vehicle’s value.

But the amount of funding provided to localities hasn’t changed since 2007, and Virginia now provides 20% less relief. In other words, both taxpayers and the county government are getting significantly less money from the state than they did 16 years ago.

After cutting another 15% for fiscal year 2023, which began July 1, 2022, the Fairfax County board is asking to get more money back from the state — a request also made to the governor last year, McKay’s board matter notes.

Youngkin has suggested cutting the car tax entirely, but county officials have expressed some trepidation about the consequences unless the money is reimbursed. McKay said reimbursement might be possible now considering the state’s nearly $2 billion surplus.

“While either the state or county could eliminate car taxes all together, the state should honor its pledge of 1998 to eliminate the car tax while reimbursing local governments for lost revenue,” the letter to Youngkin says. “It is essential and possible, particularly as the state currently sits on a significant surplus, to allocate adequate funding to provide residents with effective personal property tax relief.”

Braddock District Supervisor James Walkinshaw argued that the state can’t truly claim to have a surplus until “the Commonwealth pays its bills…and this is an example.”

“If it doesn’t happen this year with the surplus that exists, it ain’t going to happen next year or the year after that,” he said.

While the governor already released his budget last month, amendments — including one to offset lost vehicle tax revenue — could still happen at the direction of the General Assembly.

Fairfax County’s top priorities for 2023 will be increasing mental health services, boosting police retention, addressing commercial office vacancies, and improving pedestrian safety, Board of Supervisors Chairman Jeff McKay says.

Adequately addressing those needs, though, requires more financial help and local authority from Virginia’s General Assembly, he told FFXnow in an interview.

With the county increasingly reliant on real estate taxes, officials expect this budget cycle to be one of the most challenging in a decade.

As property values rise, the tax burden on property owners is already “significant” and hurting residents, McKay said. To not “exacerbate” the situation, the county likely needs to lower the real estate tax rate.

“I personally believe absolutely we have to reduce the tax rate as a part of this next budget,” McKay said.

Continued recovery from the pandemic is paramount, informing all the board’s priorities for the upcoming year, McKay said.

While economic recovery from the pandemic tends to get a lot of attention, there remains “a lot of work to do” on human services, according to the chairman.

“The thing that keeps me up at night is the ongoing growth of mental health challenges, especially with some of our young people,” McKay said. “I do think that a good chunk of that is a byproduct of what we’ve been through with Covid.”

Mental health-related challenges affect everything from police calls to unemployment and schools, he said. The county’s current budget gave close to $186 million to the Fairfax-Falls Church Community Services Board, which provides support services.

McKay believes the state’s $37 million contribution isn’t enough, arguing that mental health funding should be “primarily a state responsibility.”

“This is something the state has to get really serious about addressing,” he said. “Frankly, if they provided the level of support that the county did, we probably wouldn’t have near the mental health challenges in Virginia that we have now.”

Increasing mental health services could mean more educational programs, staffing, and supportive programs.

It also ties into public safety, as the Fairfax County Police Department struggles with understaffing and retention. McKay says officers are being asked to take on responsibilities that they shouldn’t have to handle.

“Increasingly our police are almost being asked to be mental health clinicians [when then are] mental health service calls,” he said. “It’s stressing them out and getting people not interested in joining police departments.”

In 2021, the county instituted a co-responder program where a crisis intervention specialist joins police officers on certain mental health-related calls. Alongside the county’s Diversion First program, launched in 2016, it provides treatment to individuals instead of incarceration. McKay says the programs need to “grow dramatically.” Read More

(Updated at 1:15 p.m. on 11/30/2022) Local officials are already preparing for “one of the most challenging” budget talks in years due to inflation, the changing real estate market, and staff retention challenges.

Right before the Thanksgiving holiday, Fairfax County staff offered supervisors and the school board an early look at projected revenues, expenditures, and points of potential discussion as the county and Fairfax County Public Schools (FCPS) prepare to release proposed budgets early next year.

The fiscal year 2024 budget forecast that staff presented on Nov. 22 didn’t paint a particularly rosy picture, however.

Board of Supervisors Chairman Jeff McKay called the forecast “a real mixed bag.” County staff said that generated revenue remained “healthy,” but others weren’t so sunny.

“This is probably going to be one of the most challenging budgets in my 11 years on the [school] board,” Braddock District School Board representative Megan McLaughlin said. “It’s going to be a tough one.”

Springfield District Supervisor Pat Herrity concurred, saying there wasn’t “a lot of good news in here.”

As is the case across the country, the local real estate market has been slowing due to increasing interest rates and rising prices. While it increased from last year, growth is expected to flatten going forward for the rest of 2022 and into 2023.

Non-residential tax revenue is in even worse shape, at least partially due to the change in work-from-home habits resulting from the pandemic. It’s expected to increase by only 0.6% compared to last year when the growth was about 2.3% compared to 2022.

While hotel, retail, and apartment revenues are all expected to increase next year, office revenue is expected to decline between 5% and 6%, raising concerns among some supervisors and school board members.

Braddock District Supervisor James Walkinshaw said he has talked to companies in the county that have no intention of renewing office leases due to decreased need with more employees now teleworking.

He called it a “slow-moving crisis” that could create a “very significant hole” in terms of missing revenue.

“[This] is very troubling,” Walkinshaw said. “It’s a structural challenge now in our economy…I’m not confident we have our arms around what that challenge is going to look like over the next 5 to 10 years.”

New construction and transient occupancy (or lodging) tax revenue are also expected to grow, but at much lower rates than prior to the pandemic.

Real estate taxes are the largest source of revenue for the county, providing more than two-thirds of generated money. Last year, home values soared, while commercial tax revenue dropped, resulting in a 3-cent decrease in the real estate tax rate.

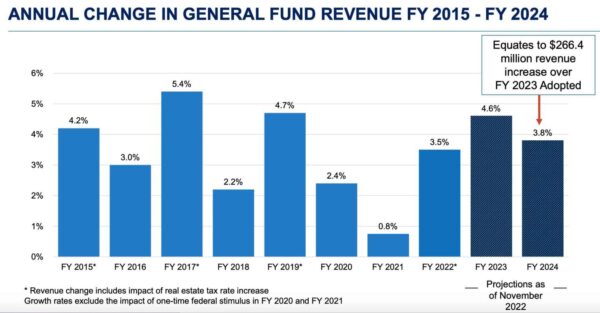

All told, revenue is predicted to rise by about $266 million, a 3.8% increase from last year, per the presented forecast.

However, revenue isn’t keeping pace with expenditures, due mostly to anticipated staff salary increases.

Between recruitment and retention challenges and inflation, an additional $159 million will be needed for salaries and benefits compared to the current budget — plus another $113.5 million for school staff. Adding in other costs, the county and FCPS are looking at a combined shortfall of about $125 million for fiscal year 2024, which begins July 1, 2023, staff said.

Since this is a baseline forecast, a number of county and school priorities were not taken into account, including infrastructure upgrades, increased investments in affordable housing, and an expansion of early childhood education programs.

As county staff and McKay both reiterated, the forecast is only an estimation subject to change.

“As the economic outlook is uncertain, staff is approaching FY 2024 revenue forecasting very conservatively,” the presentation said.

Adoption of the fiscal year 2024 budget remains six months away. Advertised budget plans for the county and schools will be released in February with final votes coming in May 2023.

(Updated at 1:45 p.m.) Fairfax County is considering automatically filing vehicle tax returns for residents in the future, potentially saving more than 70,000 residents money.

At last week’s Board of Supervisors meeting, elected officials authorized a public hearing for Dec. 6 to discuss a possible county code change that would eliminate a step for residents when registering a vehicle.

Currently, when a resident registers a motor vehicle, trailer, or semitrailer, the Department of Motor Vehicles (DMV) notifies the county. Then, the county’s Department of Tax Administration (DTA) sends “a courtesy letter” to the resident reminding them to separately file a tax return within 60 days.

If the resident doesn’t register in that time, they face a 10% penalty on top of their owed personal property taxes.

Approximately 72,000 residents do not file tax returns for their vehicles in a timely fashion on an annual basis and are subject to the 10% penalty, a DTA spokesperson told FFXnow by email.

On average, that’s about 54% of residents who either bought a new vehicle or moved one into the county, they said.

If approved, the proposed change would eliminate that extra step. The county would automatically file the personal property tax return on the resident’s behalf within 30 days.

(Correction: This story initially said the DMV would automatically file tax returns for residents, but a Fairfax County spokesperson clarified that the filing would be done by the county itself.)

The amendment would also get rid of the 10% late penalty “if the vehicle is timely registered with the DMV,” notes the staff report. If approved, the change would go into effect on Jan. 1, 2023.

“This proposed change will make it easier for taxpayers, as well as help them avoid unnecessary penalties,” the DTA spokesperson said. “Many taxpayers who buy a new vehicle or move one into the county don’t understand that they are required to separately file a personal property tax return in addition to registering it with the state Department of Motor Vehicles.”

The proposed amendment would also clarify that taxes on trailers and semi-trailers would be prorated based on when ownership changed during the calendar year.

Getting rid of the late penalty would result in a loss of about $2.4 million in revenue for the county on annual basis.

“The potential loss incurred is a small fraction of the revenues generated from the personal property tax,” the spokesperson noted.

In the current fiscal year 2023, though, the net loss would be about half of that since the change in code would not be retroactive, with January marking the halfway point of the fiscal year.

The adopted 2023 budget already reflects the potential $1.2 million loss, per the staff report.

Personal property tax assessments climbed for about 90% of local vehicle owners this year, prompting the Board of Supervisors to approve relief in the form of a 15% reduction in taxes.

Fairfax County deserves more local authority, Board of Supervisors Chairman Jeff McKay says, calling Virginia’s Dillon Rule “increasingly more intrusive” in day-to-day operations.

The Dillon Rule dictates that localities only have the authority to create laws, set guidelines, and wield power if the state expressly grants it to them.

However, McKay argues this system treats counties as so “unsophisticated” that they need the state to make decisions for them — an assumption that seems particularly outdated for a locality like Fairfax County, which is home to nearly 1.2 million people and an annual budget of $4.7 billion.

“It’s a…broken, inconsistent, and non-responsive system for our constituents that needs modernization,” McKay told FFXnow. “Every time we need something, we’ve got to go to Richmond and beg because most [Virginia] localities don’t need or want that authority. And that’s a problem.”

McKay told Axios D.C. last month that he wanted the county to have more control over its destiny, including the option to levy personal income taxes.

He calculated that Fairfax County only gets 23 cents for each dollar it pays in state taxes. While some disputed that exact calculation, McKay says the county sends enough revenue to the state that it should have more authority to determine how it’s generated.

“I think the county should have the authority to levy any tax that they want and let their voters hold them accountable,” he said. “The state should not be telling them, ‘You can’t raise revenue this way or that way or any other way.'”

If allowed to do this, he would consider a personal income tax as a means to lower — or, even, eliminate — the real estate tax, which provides over $3 billion, or roughly 68% of the county’s annual revenue. He says it would be a fairer, more equitable, and less risky way of raising revenue.

The Dillon Rule’s restrictions on local authority go beyond taxes, hampering day-to-day operations of the county, McKay says, arguing that the “one-size-fits-all” mentality of governing no longer works in a state where counties are diverse in size, population, and budgets.

For instance, rewinding to 2020, McKay says he and other Northern Virginia leaders had to “compel” then-governor Ralph Northam to delay rolling back Covid restrictions in the region.

At the time, Fairfax County’s infection numbers were a lot closer to those in D.C. and Montgomery County than to Roanoke or smaller Virginia localities. Yet, while D.C. and suburban Maryland could keep their covid restrictions in place, Northern Virginia was initially on the same timeline as the rest of the Commonwealth.

“I didn’t have the same authority that they had to do what they were doing,” McKay said. “I was beholden to negotiating, in essence, with the governor about what was in the best interest of Fairfax County.”

McKay says the Dillon Rule is also a factor in the case of the Glasgow Middle School counselor who was arrested last year for a sex crime but stayed employed by Fairfax County Public Schools for months after.

“Another example of a challenge in my community that…fell through the cracks because of a lack of detail, lack of aggressiveness, and lack of awareness of what the Virginia standard or requirements are for localities reporting these incidents,” he said. Read More

The redevelopment of downtown Herndon by Reston-based developer Comstock has been officially been put on pause.

But Fairfax County’s commitment to provide $6.2 million remains unchanged, according to the county.

The plan would redevelop nearly 5 acres of land into a mixed-use project with 273 apartments and roughly 17,000 square feet of retail. An arts center and a 726-space parking garage are also part of the project.

“The market pause has delayed when those payments are expected to be made between the County and the Town due to the construction delays pushing out the previously mentioned payment triggers. The overall obligation remains in place for the County to provide those payments to the Town when those phases are met,” said Scott Sizer, catalytic development division manager of the Fairfax County Department of Economic initiatives.

The county offered two pledges for the public-private partnership. The first agreement of $1.2 million — approved in 2018 — kicks in when Comstock and the Town of Herndon have contributed at least $1.2 million in value for the construction work.

Sizer says that’s expected to happen after building construction begins.

The second agreement states that the county’s contribution of $5 million will happen after the first residential structure gets its first occupant. The payment — which will likely take place at the end of site construction and the beginning of operations of the apartments — will include annual payments over five years, Sizer said.

A spokesperson for Comstock told FFXnow that no timeline is currently available for when the project might begin.

The project, which was expected to break ground nearly two years ago, could be on pause for up to two years, the town stated in July.

The cost of the $101 million project increased by $25 million due to issues related to materials, labor, and workforce restrictions caused by the pandemic, according to town officials.

In addition to support from the county, Comstock will receive $2.5 million in fee reductions and $1.9 million in real estate tax breaks through an ordinance that was established after the town approved the project.

The project has been marred by delays since its inception. Groundbreaking was originally planned for December 2019.

Two Face Drug Charges After Seven Corners Police Shooting — “Two men have been charged after an officer-involved shooting that occurred last night at approximately 10:45 p.m. in the 6100 block of Arlington Boulevard in Seven Corners…The officer involved in the shooting has been identified as an 11-year veteran assigned to the Street Crimes Unit.” [FCPD]

Local LGBTQ+ Student Group Speaks Out — Fairfax County’s Pride Liberation Project released a statement backed by more than 600 students criticizing a proposal from the state Department of Education that they fear will classify any references to LGBTQIA+ people and events as sexually explicit. The guidelines address a new law that requires parents to be notified when school materials include sexually explicit content. [The Washington Post]

Meet Reston Association’s New CEO — “On Thursday, July 28, the Reston Association board of directors voted unanimously to confirm Mac Cummins, AICP* as the next chief executive officer of the non-profit organization…Cummins sat for a Q&A with the Connection Newspapers on Friday, July 29.” [Connection Newspapers]

Police Chief Addresses Staffing Emergency — The Fairfax County Police Department declared a personnel emergency last week, requiring officers to work mandatory overtime to compensate for staff shortages. Chief Kevin Davis says the department’s 189 operational vacancies are exceptionally high, though 51 recruits currently in the academy will eventually join the force. [ABC7]

Back in Nature, Snake Found in Fairfax Is Healing — “K2C Wildlife Encounters, LLC, received a call on June 5 from a Fairfax resident who had a snake in their backyard that they wanted removed…The female, eastern ratsnake had a torn jugular vein, a hole in her trachea, a protruding eye, numerous lacerations, and broken ribs.” [Patch]

New FCPS Teachers Prepare for School Year — “Minutello and Edinborough are among the newest teachers in Virginia’s largest school system, and are starting at a time when staffing challenges are making headlines. The county had hundreds of vacancies at the end of the last school year, but 97% of staffing positions have been filled as of last week, Superintendent Michelle Reid said.” [WTOP]

Centreville’s Ellanor C. Lawrence Park Lot to Temporarily Close — “The parking lot and entrance for Cabell’s Mill will be closed from Aug. 8 through Oct. 7, 2022, for construction. Work related to the new Stewardship Education Center will include a larger parking lot that will include features and a design that will better control and filter water from rain and runoff from the adjacent neighborhood.” [FCPA]

State Sales Tax Holiday Starts Tomorrow — “The 3-day sales tax holiday starts the first Friday in August at 12:01 am and ends the following Sunday at 11:59 pm…During the sales tax holiday, you can buy qualifying school supplies, clothing, footwear, hurricane and emergency preparedness items, and Energy Star™ and WaterSense™ products without paying sales tax.” [Virginia Department of Taxation]

It’s Thursday — Humid throughout the day. High of 95 and low of 76. Sunrise at 6:14 am and sunset at 8:18 pm. [Weather.gov]