Developers are asking for public help to redevelop the Huntington Club condominium community, but officials worry the condo owners are unclear of the risk involved.

At an economic initiatives committee meeting on Dec. 13, the Fairfax County Board of Supervisors got an update on phase one of the redevelopment and what’s needed financially to get it underway.

Currently, the Huntington Club is a 364-unit condo complex between N. Kings Highway and Huntington Avenue, adjacent to the Huntington Metro station. A three-phase plan to redevelop the 19.5-acre property to be denser was approved in December 2021, promising 2,000 multifamily units, 200 townhomes, and multi-use space for retail, senior living, and possibly a hotel.

The redevelopment would be a major complement to a development plan for the Metro station area, which is also in motion, developers argue.

However, the land owners don’t have enough upfront cash to start the townhomes and multifamily units envisioned for phase 1 of the project.

“The [land owners] are insufficient cash-wise to cover infrastructure costs for phase 1,” Fairfax County Debt Coordinator Joe LaHait told the supervisors at the meeting.

Because they don’t have the funds needed to cover infrastructure, if the county doesn’t step in, the redevelopment won’t be able to move forward, LaHait reiterated. Hence, developers are asking for help in the form of $45 million worth of publicly issued bonds.

The county has started down the path toward fulfilling the request, but it’s proposing to take a somewhat unique approach.

The county would establish a community development authority (CDA) to borrow the money. A CDA is a public entity governed by a board with the power to issue bonds. This mechanism was used to help get the Mosaic District built over a decade ago.

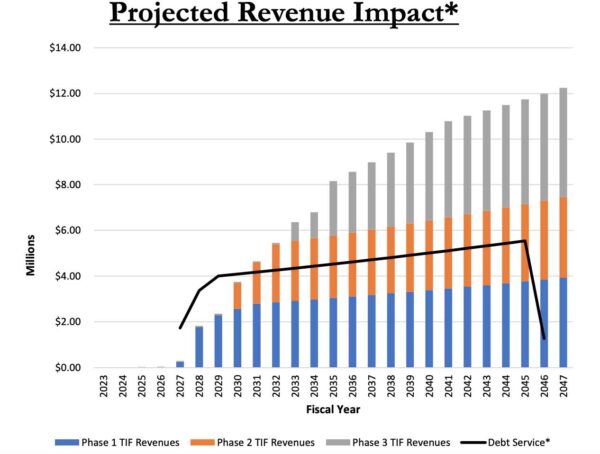

The CDA would pay back the $45 million in bonds through tax increment financing (TIF), which is the difference between taxes generated before and after redevelopment. Once the bonds are paid back, the county can keep the extra money.

Right now, the Huntington Club pays the county about $800,000 in tax revenue, per the Washington Business Journal. The redeveloped property could generate upwards of $10 million annually.

While the county board needs to approve the CDA’s creation and the issuing of the bonds, what’s enticing is that significant extra money and the fact that the county wouldn’t be on the hook if values don’t rise as quickly as hoped.

The condo owners are the ones who would assume the risk.

The Huntington Club was initially built more than five decades ago and its redevelopment has been planned dating back at least five years.

In 2017, the condo association voted to terminate itself, reportedly becoming the first organization of its nature to do so in the country. The move allowed owners to sell land in order to have cash for the redevelopment.

Many condo owners “opted out” of this deal, meaning they would take the cash made from their property and leave. However, 138 owners — about 40% — opted in, becoming part of a “tenancy-in-common.”

The benefit is that, when the redevelopment happens, there’s a good chance that the owners who opted in will command significantly higher prices when they decide to sell their units than in 2017 and today.

However, if the development takes longer than expected, which is a strong possibility, those owners would be on the hook for a targeted tax hike for a period of time.

“If delayed, the property’s existing owners might be obligated temporarily — perhaps for several years — to pay some extra taxes to cover the gap,” the WBJ explained.

That’s where the supervisors have concerns: that the condo owners might not completely understand what’s going on. If there’s a delay, those owners might have to foot tax bills upwards of an extra $11,000 a year — and if they default, they could face foreclosure.

“My concern…is the residents understanding what the impact will be to them,” Sully District Supervisor Kathy Smith said. “What’s so different about this is that you have homeowners who are the developers and…I’m concerned about the worst case scenario is that people default, they’ll lose their properties.”

Supervisors urged better and more frequent communication with the condo owners to ensure they proceed with “eyes wide open,” as Mount Vernon District Supervisor Dan Storck put it.

To protect those owners, the county is advising the Huntington Club to set aside $5 million ahead of time. That amount is “equal to the first four years of estimated Special Assessment risk,” the staff presentation says.

At the moment, the Huntington Club is considering the advice, but the county is strongly considering putting it into a signed agreement that includes public financing.

The hope was to do the CDA bond sale by next October, per staff, but that timeline might be aggressive and not allow for the needed vetting, several supervisors noted

Recent Stories

Owners of six Woofie’s franchises in Northern Virginia are hosting “Paws in the Park,” a pet adoption event on May 18 at 10 a.m. to 3 p.m. (rain date May 19) at Wolf Trap National Park, Wolf Trap Farm Park, 1645 Trap Road, Vienna. They hope to bring awareness for local animal shelters and the need for “furever” families for animals.

Woofie’s will have about 20 mobile spa vans on site, offering free nail trims and Wash ‘n Go baths for rescued dogs and pups up for adoption, and special event pricing for families who bring their own pets for grooming (as time permits/allows).

Participating Woofie’s include Reston/Herndon, Ashburn-Leesburg, McLean, Western Loudoun, South Riding-Aldie and Fairfax. Food trucks, a DJ, local vendors, and more will be available. Ridgeside K9 and Keller Williams Realty are sponsoring the event.

The Blue Swallow Farm Foundation is holding an online auction to celebrate three years of helping students and educators in outdoor instruction. We invite you to participate in our online auction to support our mission of providing authentic, outdoor experiences for children. This event not only serves as a fundraiser for our initiatives but also as an opportunity for you to acquire unique items and experiences while making a positive difference in the lives of students and educators. You can preview auction items and then register as a bidder. Bidding will begin on May 4. The bids will close on May 8. Proceeds will assist us in helping educators build outdoor classrooms, developing high-quality curriculum materials and professional development workshops, sending teachers and students to environmental youth summits, and assessing the benefits of outdoor learning.

Pedal with Petals Family Bike Ride

Join us on Saturday, May 11th and ride into spring during our Pedal with Petals Family Bike Ride. Back for its second year, Pedal with Petals is going to be bigger than ever. This year’s event will include both an

Dream, Design, Build: Home Expo 2024

Sponsored by ABW Appliances & Eden, join us for a one-of-a-kind Home Expo event on May 11th from 10AM to 4PM!

The DMV’s top experts — AKG Design Studio and GMJ Construction — are opening their doors to homeowners to